You’re ready to make the leap into the world of digital money; but how to buy cryptocurrency? Whether you’re looking to buy Etherium, Bitcoin or whichever dog-inspired coin Elon Musk is tweeting about this week, our step-by-step guide will have you rolling in those virtual coins in no time.

October 20th, 2021| Mike Humphrey

Table of Contents

What is Cryptocurrency

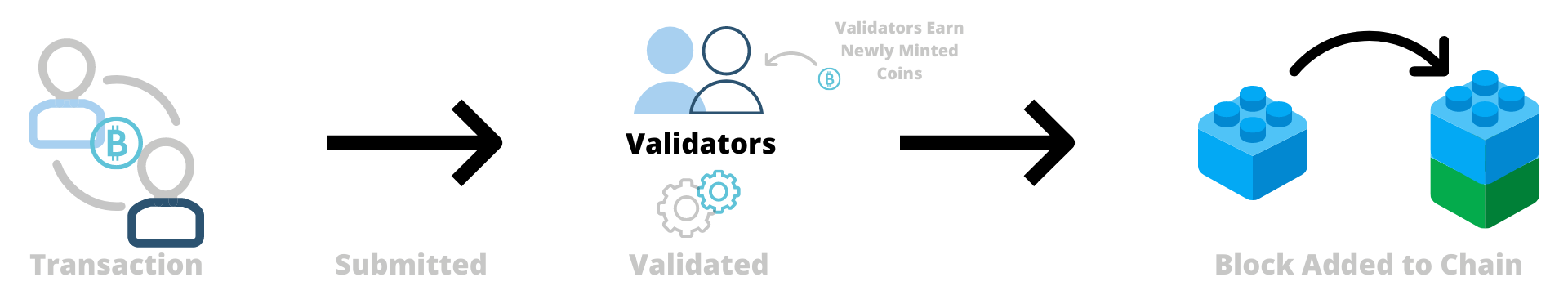

First things first, let’s get a handle on what cryptocurrency is. A cryptocurrency is a form of digital money or coin. Unlike traditional currencies that are issued by a central bank, like the U.S. Federal Reserve, cryptocurrencies are issued on a blockchain. Every time a coin is sent from one person to another, a network of validators must review and approve the transfer. Once approved this transaction or block is added to the previous block making a chain of approved transactions, also known as a blockchain. Every validated transaction earns the validators newly minted coins which then go into circulation. This means coins are minted or created by the validators of the blockchain instead of by a central bank, making the coin decentralized. Validators can be crypto miners using proof of work, or coin holders using proof of stake. This depends on how the blockchain is set up with different chains (coins) having different validation methods.

Each cryptocurrency has a different blockchain or “central bank.” This means that many of the coins are not directly interchangeable; each chain is different and the blocks cannot be fit together. To trade between coins on different chains you would need to buy and sell them on an exchange similar to how you buy and sell stocks.

Top 4 cryptocurrencies by market cap:

| Coin | Symbol | Chain |

|---|---|---|

| Bitcoin | BTC | Bitcoin |

| Etherium | ETH | Etherium |

| Binance Coin | BNB | Etherium Fork |

| Cardano | ADA | Cardano |

Enough with the explanations, let’s buy some crypto!

Step-By-Step Guide To Buying Cryptocurrency

-

Choose a Crypto Coin

As mentioned above each coin exists on a blockchain, many of which are not directly interchangeable. This impacts which wallets you can use and how you go about purchasing each coin. The coin you choose will also impact your investment strategy for that coin. Some blockchains have more capabilities than others. Bitcoin for example can only perform simple transactions, whereas Etherium and the Binance Smart Chain can execute contracts (multi-tiered transactions that are coded directly into the blockchain). Contracts are the building block of decentralized finance (De-Fi) and allow you to loan and borrow coins in various protocols. Whichever coin you choose, the next step is to select a wallet to send those coins to.

-

Choose Your Crypto Wallet

A cryptocurrency wallet is in some ways very similar to the wallet you might have in your back pocket. A crypto wallet however differs in that you don’t actually carry your money with you. A crypto wallet consists of an address (a set of numbers and letters that identify your individual wallet) and a private key (the code required to be able to access your wallet). When sending a transaction you need your wallet address, the other person’s wallet address, and your private key to allow that transaction to happen. Your coins never actually leave the blockchain, but rather coins are identified as being at your wallet address on the blockchain. People who lose crypto coins have actually lost their private key and can no longer access the coins that are sitting on the blockchain at their wallet address. You can read our complete guide to crypto wallets to find out more.

Software Crypto Wallets

A software wallet is a program that stores your private key in its software. Software wallets are easy to use and let you check your balances and interact with De-Fi websites quickly and easily. These web3 enabled wallets are the backbone of De-Fi and are the key to quickly and easily using De-Fi Apps (DApps). The downside to software wallets is that your private key is stored either on your computer or inside your web browser, this creates the potential to have your private key stolen.

Below is a list of some of the top software wallets currently available. I have provided links in the list below, but be sure to take the time to check the website you have gone to as well as the download location for the browser extension.

Web Crypto Wallets:

- Etherium Wallets

- Binance Wallets

- Cardano Wallets

Hardware Crypto Wallets:

A hardware crypto wallet stores your wallet’s private key on a hardware device that needs to be connected to the computer any time you make a transaction. It adds a level of security that limits how easily someone can access your cryptocurrency. There are two main crypto hardware wallets on the market Ledger and Trezor. Both wallets offer a web interface to set up your wallets and also integrate with MetaMask. Be aware you need to set up your wallet on Ledger or Trezor first and then add the wallet to MetaMask. Every time you make a transaction with your wallet you will have to connect the hardware wallet and authorize the transaction from the device. As with all wallets, security is critical. Only purchase your hardware wallets directly from either Trezor or Ledger.

A Further note on security: Keeping your private keys safe is critical to ensuring your cryptocurrency does not get stolen! Keep your keys safe, never save them on your hard drive, write them down and keep them in a safe spot, and remember not your keys, not your crypto! Keeping your crypto on an exchange where you don’t control your key means it can be stolen – – Coinbase Hacked

-

Decide How You Want to Pay

With the rise in popularity of cryptocurrency more and more payment options are becoming available to crypto investors. Whether you want to make a bank transfer, pay with your credit card or pay with Paypal, there are different platforms that support different options.

- Bank Transfer: Purchasing cryptocurrency through a bank transfer can be an easy way to buy digital coins. It involves registering on a crypto purchasing site, setting up an account and a wallet, and then sending funds from your bank to the site. It’s a secure method of transfer, but you should be aware that it creates a paper trail. For many investors, this is not a problem, but if your primary concern is privacy and anonymity, a bank points back directly to you through your bank account.

- Credit Card: Using a credit card to buy cryptocurrency offers a quick and easy way to purchase your first crypto coins. Again this method can point back to you directly through the credit card, but it does offer the added benefit of being able to void a transaction in the case that you want to cancel the purchase. You should also take into account that you are purchasing a potentially volatile asset using debt, and credit card debt often comes with a hefty interest rate. I would not recommend using a credit card unless you have a plan to pay off the card immediately. The purpose of purchasing cryptocurrency as an investment is gains and carrying a balance with a high interest rate will quickly cut into any of your returns.

- PayPal: If you run an online store or receive payments through Paypal, this can be a great option to quickly and easily purchase cryptocurrency. Your funds are already accessible online which makes the purchase process a little easier. As with the above methods, your crypto purchases can be traced back to you through your Paypal account details. In the U.S. you can purchase cryptocurrency directly through PayPal, and they have plans to open this up to other countries over time.

-

Choose Where You Want to Buy From

There are three main places to buy cryptocurrency – exchanges, PayPal, and 3rd party services/institutions. Cryptocurrency exchanges function like the stock market allowing you to easily purchase and exchange coins. Often crypto exchanges will create your wallet for you which means they hold the private key to your wallet. This can present a risk as you don’t actually have control of the funds in your wallet. Third-party crypto purchasing services and pseudo exchanges are another method of purchasing crypto. These services will often have exchange-like features, or may simply offer the ability to deposit Fiat which you can then exchange for Crypto. Again, these services may create wallets for you, but we recommend creating your own and transferring your coins to a wallet that you fully control. Each of these options provides different levels of security and anonymity. The list below gives a summary of some of the options available.

- Crypto Exchanges

- PayPal (U.S. Only) If you live in the United States (excluding Hawaii) you can now purchase cryptocurrency directly through PayPal and send it to your crypto wallet. PayPal will allow you to buy, sell and hold cryptocurrency without ever having to leave PayPal. All trades must be executed in U.S. Dollars (USD) and users must have a Personal PayPal Cash or PayPal Cash Plus account. PayPal plans to extend this service to other countries within 2021.

- Other Options

- Buy Cryptocurrency in Canada

- Coin Smart offers Canadians a user-friendly coin exchange that allows you to transfer funds by Interac, SEPA, Wire Transfers, and E-transfers. Funds can be accessed the same day they are deposited, giving you immediate access to the market. Coinsmart offers Bitcoin, Etheriumn, Litecoin, XRP, Bitcoin Cash, XLM, EOS, Tether, USD Coin, and Cardano purchasing and trading.

- Shakepay is a Canadian-based platform that allows you to purchase Bitcoin or Etherium. Simply transfer your funds to your Shakepay account using an interact transfer and then use these funds to purchase either Etherium or Bitcoin. The process is quick and easy and funds are immediately transferred into your Shakepay wallet that is created when you purchase. You can then send your new coins to your private wallet on an exchange.

- Wealth Simple is another purchase/trading platform for Canadian investors. They offer over 25 coin options to choose from including many ERC20 De-Fi platform coins, as well as Bitcoin, Etherium, and Cardano. If you are looking to get more involved in De-Fi and want to purchase coins directly with Fiat (dollars) then Wealth Simple may be the platform for you. There are zero fees on deposits and withdrawals.

- Buy Cryptocurrency in Japan

- BitFlyer is a crypto exchange platform in Japan. If you live in Japan this is the best way to purchase and trade cryptocurrency.

- Buy Cryptocurrency in The United States

- CashApp primarily allows you to transfer money, though it does also allow you to purchase stocks and Bitcoin (similar to Robinhood). Its simple and easy-to-use interface makes it ideal for first-time crypto buyers.

- Bisq is a little different than most of the other sites listed here. It is a decentralized exchange that allows you to swap your funds with other users. It allows you to buy and sell Bitcoin for Fiat (or other cryptocurrencies) privately and securely using a peer-to-peer network and open-source desktop software. There is no registration required.

- Buy Cryptocurrency in Canada

Conclusion

With your wallet in hand and newly purchased crypto, you are ready to take on the world of digital currency. Be sure to take a look at some of our other articles to find out what you can do with your new coins.

Let us know if the article was helpful in the comments below

Hi I’m Mike, an active crypto investor DeFi enthusiast and crypto miner. I have been involved in crypto since March of 2021 and in DeFi since May 2021.

I’m also an avid outdoor adventurer!