Make your Ethereum work for you. Stake on an exchange, in a DeFi protocol or run your own node. Learn all about Ethereum staking below.

January 3rd 2022| Mike Humphrey

Table of Contents

Proof of Work Vs Proof of Stake

To secure the Ethereum blockchain, a network of decentralized validators is required. Validators review and approve all transaction that happen on the blockchain, and ensure its security. Currently the majority of Ethereum transactions are validated by crypto miners. By solving cryptographic equations, the miners review and accept transactions and add them to the block chain. This is called proof of work. Since inception, Ethereum has been trying to move away from proof of work to proof of stake. In a proof of stake validation system, investors stake their existing Etheruem which is then used to review and validate transactions. Proof of stake is much less energy intensive and is therefore more environmentally friendly.

Ethereum 2.0

Ethereum 2.0 will happen when the blockchain fully transitions from proof of work to proof of stake. The Beacon Chain which went live December 1st of 2020 was the first step in moving to poof of stake. It currently operates in parallel to the Ethereum Mainnet. When ETH 2.0 goes live, the two chains (Mainnet and Beacon), will merge and validation will be by proof of stake rather than crypto mining.

Ethereum 2.0 Execution Plan

-

Beacon Chain

Introduction of the Beacon Chain and Proof of Stake to Ethereum.

-

The Merge

The two blockchains (Mainnet and Beacon) will “dock” and the Beacon Chain will become the settlement layer for Ethereum.

-

Shards

Creation of multiple blockchains that run concurrently. The goal is to increase the transaction throughput of the Ethereum network by adding 64 shards. Each shard will function as its own blockchain that can concurrently settle transactions.

What is Ethereum Staking

Staking is the act of depositing Ethereum in order to validate the blockchain. In order to set up a validation node, a deposit of 32 Eth is required to activate the validator software. Validators are responsible for storing data, processing transactions, and adding new blocks to the blockchain. In return validators earn ETH rewards. Staking is easier than mining, and the more people who stake, the more decentralized and secure the network becomes. When staking your ETH, it is locked in until after the merge. However, there are several DeFi staking applications that require less than 32 ETH, and give you access to your capital. Read on to find out more.

FAQ

Can anyone run a node?

Yes, anyone can host a validation node as long as they have the minimum 32 Eth. A node operator is required to be online 24/7 and there are penalties incurred if there are operating issues.

Do I need to have 32 ETH to stake?

No, you do not need to have 32 ETH to stake. A node requires a full 32 ETH, but there are pools available that allow you to combine your capital with other investors. The pool then runs the node on your behalf.

When does ETH staking start?

ETH staking started in December 2020 when the Beacon Chain went live.

When does ETH 2.0 go live?

The transition to proof of work has been a long process with significant technical challenges. The current estimated date of launch is Q1 of 2022. You can read our news article about Eth 2.0 to find out more details.

How to Stake Ethereum

There are three main methods for staking your Ethereum; through an exchange, through a DeFi protocol, or running your own node. Each method has different benefits and drawbacks.

Exchanges

A quick and easy way to stake Ethereum is through a centralized exchange. Kraken, Binance and Coinbase all have options to stake. Exchanges pool your ETH with that of other users to create nodes. You do not require a full 32 ETH in order to stake on an exchange.

ETH 2.0 Staking Pools

An Ethereum 2.0 staking pool lets you combine your capital with other stakers. It significantly lowers the barrier to entry and you are not required to run a node. For smaller investors who don’t want to deal with the hardware requirements or don’t have the minimum 32 ETH, it is a good option. Some pools have also found workarounds to give investors access to their staked ETH before the lock-in period is finished. When you deposit your ETH into one of these pools, the pool owners issues a token worth the same amount as the deposited ETH. This gives stakers access to their capital, while still allowing them to reap the rewards.

-

Lido.fi

Lido is a DeFi staking platform for ETH 2.0. Lido allows users to stake their ETH without locking in their assets or maintaining hardware. Users can stake with any amount of ETH and help to secure the platform.

How it Works

For each ETH staked on Lido the investor receives an stETH token on a 1:1 basis. The stETH represents the staked ETH. It can be used like regular ETH to earn yield in other protocols. An investors stETH balance is updated on a daily basis to reflect staking rewards and/or penalties. Through stETH stakers receive their rewards in real-time.

Lido is a DeFi application, it has been audited by Quantstamp and Sigma Prime. However, audits do not guarantee that protocols are safe. Please be sure to read the white paper and do your own research before investing.

-

Rocket Pool

Rocket Pool is a decentralized staking platform for ETH 2.0. Rocketpool offers two ways to become a staker. The first is to stake and run a node, the second is to provide capital only.

How it Works

Become a Validator

In order to become a validator on rocket pool, you must invest 16 ETH. Rocket Pool will start a node on your behalf by matching your 16 ETH with 16 ETH from the pool.Become an Investor

As an investor in the pool you can deposit as little as 0.01 ETH. Your funds will be combined funds from a validator to create and to run a node.Access to Your Capital

When an investor deposit ETH into Rocket Pool they receive rETH tokens in exchange. The value of rETH increases over time. It increases in value based on the rewards the pool receives. At the start of the pool, 1 rETH was equal to 1ETH, but over time, the rETH increases in value and because the pool has increased in size due to rewards. This method of capturing rewards may have certain tax advantages versus the re-base method used by Lido. This depends on you tax jurisdiction and how a taxable event is defined in terms of cryptocurrency.As with Lido Rocket Pool is a DeFi protocol. Before investing be sure to read the white paper and do your own research.

-

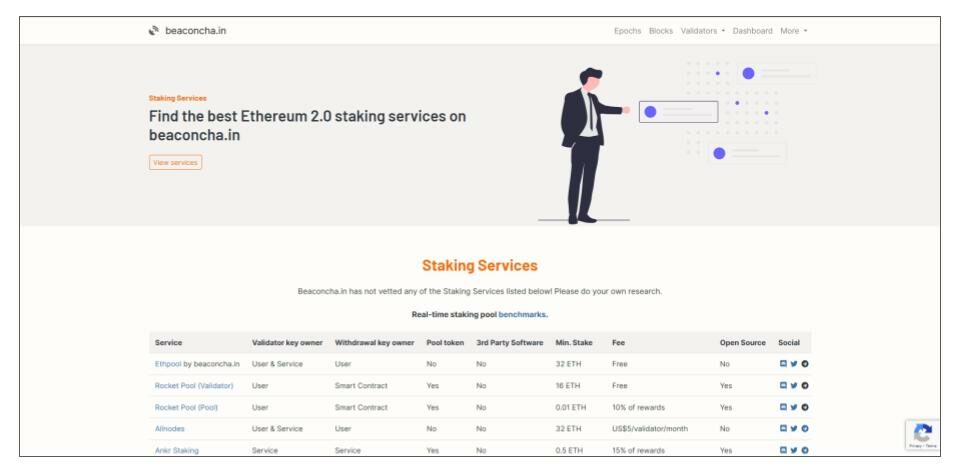

Other Pools

Etherum.org has a full List of Eth 2.0 Pools be sure to check it out for more options.

Run an ETH 2.0 Node

For investors looking to stake on their own without the support of a pool you can set up and run your own node. You will require 32 ETH, and will need to run an Eth 1.0 and Eth 2.0 client in order to verify transactions. The benefit of running your own node, is full control, and there are no pool fees. Below are the minimum requirements to run a node.

System Requirements

- Hard Drive

- SSD – In order to manage read/write speeds

- 1TB+ – Must run both Eth 1.o & Eth 2.0 Clients

- As of Feb 2021, Eth 1.0 Mainnet was ~400GB and growing at ~1GB/day

- Sharding will increase the required storage capacity when it comes online

- CPU/RAM – Dependent on your client

- Internet – 24/7 availability

- Bandwidth should not be throttled or capped

- Bandwidth – 700-800 MB/hr (this is likely to increase)

To become a validator, head to Eth2 Launchpad and follow the required steps. Below is a list of several Eth 1.0 and Eth 2.0 clients with links to their github pages. You can also take a look at the Eth 2.0 checklist for more details on requirements.

Eth 1.0 Clients

Eth 2.0 Clients

Conclusion

Whether your are looking to run your own node, or to pool your ETH with other investors, staking is a great way to earn a return. Running your own node requires some technical know how and the willingness to take on the risk of operating your own hardware. However, exchanges and DeFi platforms offer an alternative without the headache. Many of the DeFi protocols have found workarounds to allow you to use your locked in ETH and avoid the illiquidity issues.

Have You staked any ETH or do you run a node. Let us know in the comments.

Hi I’m Mike, an active crypto investor DeFi enthusiast and crypto miner. I have been involved in crypto since March of 2021 and in DeFi since May 2021.

I’m also an avid outdoor adventurer!