November 25th, 2021| Mike Humphrey

Table of Contents

What is DeFi

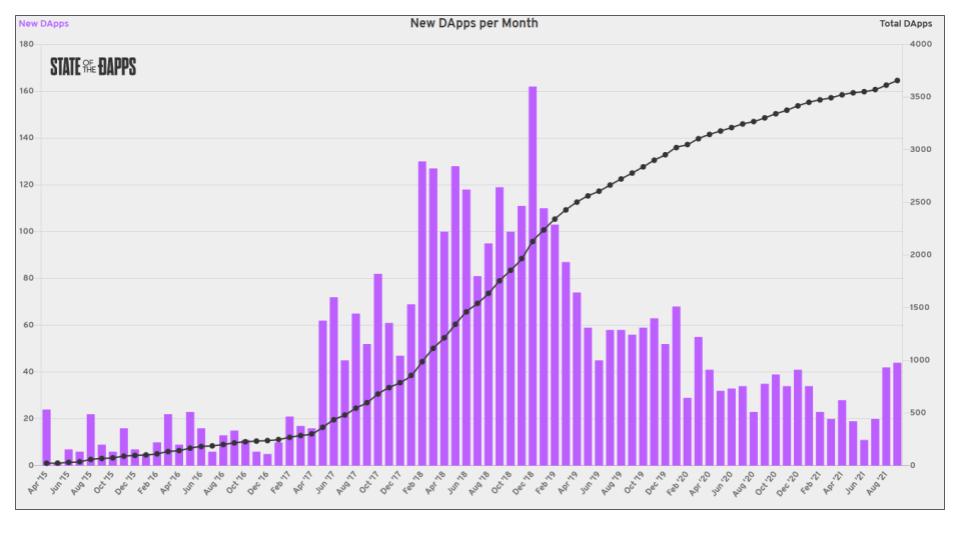

Decentralized Finance or DeFi is blockchain-based finance, that uses smart contracts to create financial instruments (loans, derivatives, insurance etc.). This is in contrast to traditional finance (Centralized Finance, CeFi) where institutions like banks, stock exchanges and the regulations placed on them, control the products offered, and who can access them. DeFi is comprised of agreements, or smart contracts that exist on the blockchain. Users sign contracts that create binding agreements through the blockchain and allow the borrowing and lending of funds. Agreements are indelible, which makes their terms and conditions secure for both parties of the transaction. This means users have access to financial products without having to go through traditional banking checks and balances (credit checks, identity checks ect.). Ethereum was the first blockchain to implement smart contracts and currently accounts for the majority of DeFi applications (DApps). DApps are protocols that use smart contracts and websites, to create online banks and lending platforms. According to The State of DApps there are over 3,600 DApps and 6,500 smart contracts being used by over 120,000 people every day.

What is a Smart Contract

Smart contracts are programs stored on a blockchain. Like a paper contract, they create the rules that participants must follow when an agreement is made. Because the program is written on the blockchain the terms and conditions of the agreement, and its enforcement are unchangeable. That means once signed, the contract cannot be altered, and transactions are irreversible. Contracts are verified and enforced through the blockchain rather than through a centralized intermediary such as a traditional securities exchange or a lawyer. Transactions are made directly between participants, mediated by smart contract programs and verified by the blockchain. Contracts are typically open-source, giving participants the ability to review terms and conditions prior to signing.

What Blockchains Support Smart Contracts

- Ethereum

- Solana

- Polkadot

- Ergo

- Alogorand

- Cardano

What are DApps

DApps are applications that allow you to interact with smart contracts and the blockchain, through a website. They typically consist of multiple smart contracts that automate workflows, triggering several actions when conditions have been met. An example of a DApp would be the Aave Protocol, an online DeFi lending and borrowing platform that operates across several chains on the Ethereum network. Access to DApps is typically through a Web3 enabled browser wallet such as Metamask.

Why is DeFi Important

DeFi represents a huge step forward. Consider the challenges of getting a bank loan with centralized finance (CeFi). When you approach a bank for a loan you will need a good credit score, you may have to submit proof of employment and even then you may not get the loan. With DeFi on the other hand, because the smart contract is enforceable regardless of who you are or what your job may be, anyone can borrow and lend. This level of freedom gives investors the ability to take part in products and services often only available to registered investors. DeFi is also exploring the frontier of finance with the introduction of never before seen solutions that are only possible on the blockchain. The value in DeFi is the ability for anyone to function almost anonymously with equal opportunity and access to financial instruments previously reserved for only the wealthy.

What are Stable Coins

Cryptocurrencies are volatile. In the last year, Ethereum has fluctuated between 400USD & 4,300USD, making it attractive to investors but a risky asset for anyone who wants to use it to pay for goods and services. Stability is rare and valuable in the world of cryptocurrency. Enter stables coins, tokens whose value is linked to real world assets (USD, Oil, Gold, Silver, EUR, etc.). They give investors a way to mitigate the risk of price fluctuations. Stable coins like USDC, USDT, UST, and Dai form the backbone of may DeFi investment strategies. Investors often deposit Ethereum or Bitcoin and borrow stable coins against these assets to use for yield farming or another strategy.

Yield Farming

Yield farming is an investment strategy used in DeFi where an investor provides liquidity to a protocol. That protocol uses that liquidity to allow other users to swap or borrow coins and pays the investor a return for providing their liquidity. Often these returns are paid in a protocol specific token. Yield farming can be as simple as depositing funds into Aave for a modest return, or can involve more complex lending and borrowing strategies using multiple protocols in order to maximize returns. Much like stocks where you can invest in high or low quality investments, selecting where and how you wish to lend/borrow is a balancing act between risk vs reward. Yield farming exists because different protocols are fighting for investors to provide liquidity, which allows their platforms to grow. The more liquidity provided (Total Value Locked – TVL) the more developers make off transaction fees. This is a win/win for investors and developers alike.

Future of DeFi

With a nascent technology like DeFi, its hard to predict what the future will hold. Can DeFi overturn CeFi? The potential is there, but DeFi needs to solve some critical issues before it can take on CeFi. Network speed and capacity (transactions per minute) are issues that will need to be solved before widespread adoption is possible. There is also the challenge of regulation. Regulators are hesitant to approve DeFi and are looking to implement strong controls in an attempt to limit the industry and protect investors. Only time will tell if DeFi can overcome. The one thing we can count on is that its potential far outweighs the current challenges.

Tell us what you think about DeFi?

Hi I’m Mike, an active crypto investor DeFi enthusiast and crypto miner. I have been involved in crypto since March of 2021 and in DeFi since May 2021.

I’m also an avid outdoor adventurer!