January 17th 2022| Mike Humphrey

Level Up Requirements

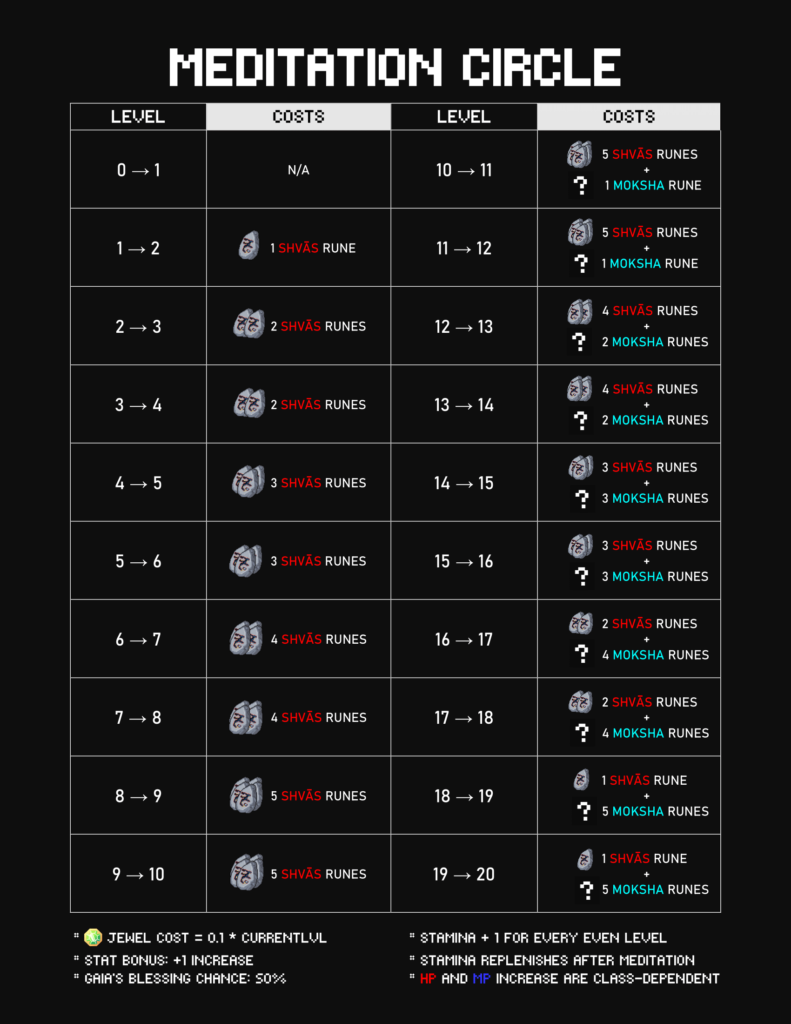

In order to level up, your hero needs to have gained enough experience, collected enough Runes, and have enough JEWEL.

Items Requirements

- Shvās Rune: Can be found questing with your hero or you can purchase them from the trader in the market place

- Moshka Rune: Moshka Runes are required to level up past level 10

- Jewel: You will need 0.1*(hero’s current level) in order to level up

See the diagram below for details on how many Runes are required for levels 1 – 20.

Experience Requirements

To level up your hero must have gained enough accumulated XP to fill their experience bar. For a level 1 hero 2000XP is required in order to become a level 2 hero. The experience required per level increases as your hero levels up.

How Leveling Up Works

When you level up, your hero has a chance to increase it’s base stats. Whether a given stat increases, depends on probability and your hero’s primary and secondary classes. You also have the opportunity to select one stat that is guaranteed to increase by +1 and 2 other stats that each have a 50/50 chance of increasing. When you level up the algorithm “rolls a die” four times to generating random numbers, which are then used to determine whether a given stat will increase. The probability for a stat to increase can be can be found in the Hero Base Stats – DeFi Kingdoms Google sheet.

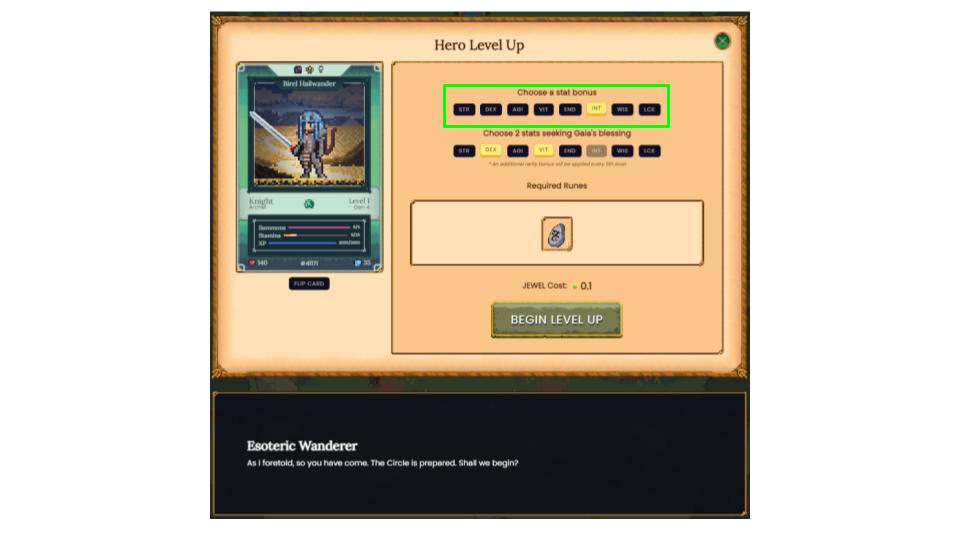

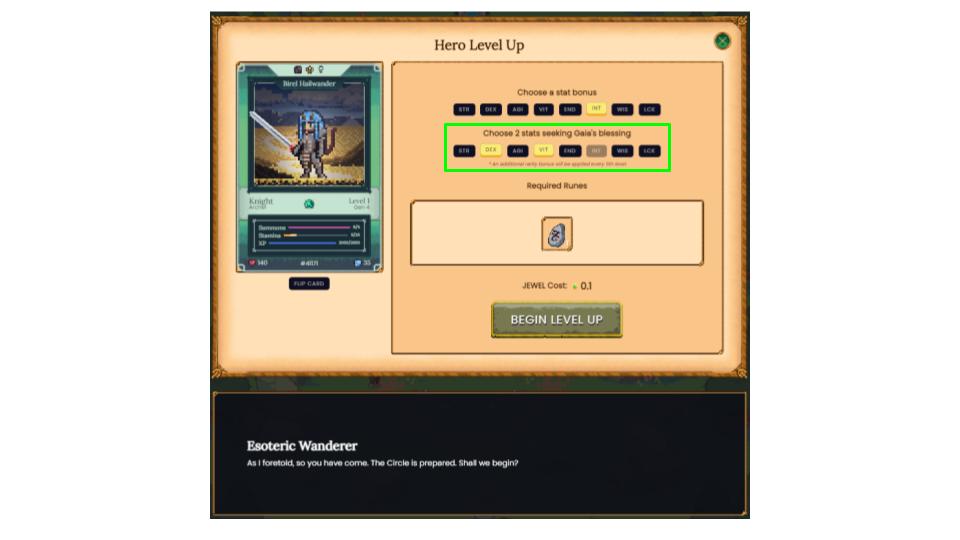

Step 1 – Stat Bonus Selection

The first step in leveling up is choosing the stat bonus. This is a guaranteed +1 increase for any stat that you select.

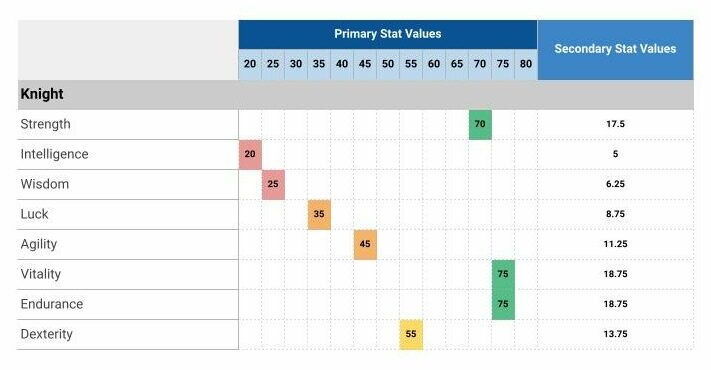

Step 2 – Primary Stat Growth (Roll 1)

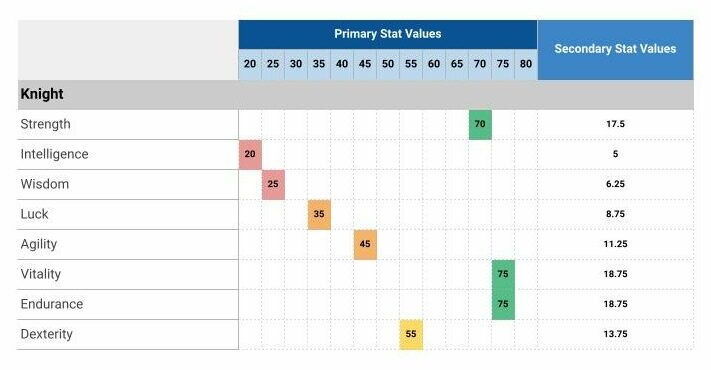

Step 2 is probability based. A randomly generated number between 1 – 100 is compared to the primary stat values for your character. If the number generated is less than or equal to the primary stat value then that stat will increase by +1. Below is a table showing the Primary Stat Values for a Knight.

For example, if a 50 was rolled for the knight above, Strength (70), Vitality (75), Endurance (75) and Dexterity (55) stats would increase because their stat values are greater than 50. Intelligence (20), Wisdom (25), Luck (35) and Agility (45) would not increase because their values are less than 50. The number that is compared to the Primary Stat Value is randomly generated and will be different each time you upgrade.

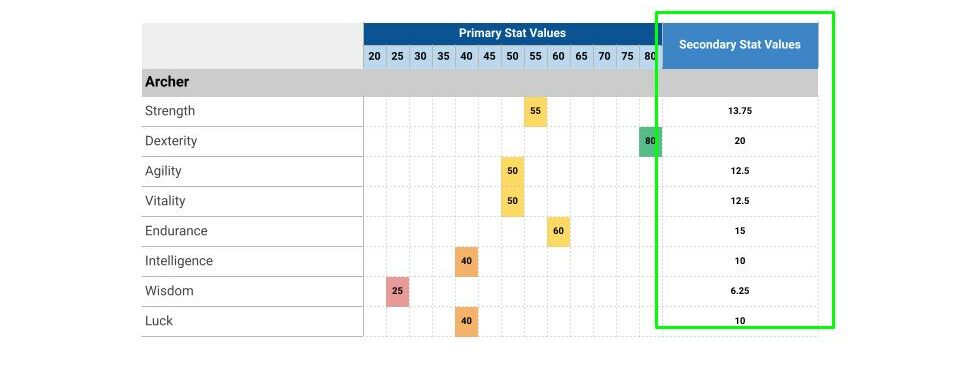

Step 3 – Secondary Stat Growth (Roll 2)

The secondary stat growth depends on the secondary class of your hero. A second number between 1 – 100 is randomly generated and is compared to the Secondary Stat Values. If the number generated during the second roll is less than or equal to the secondary stat values, then that stat will increase by +1. Below is the Secondary Stat Values for an Archer.

For example, if the second roll gave us a 19, then Dexterity (20) would increase. Strength (13.75), Agility (12.5), Vitality (12.5), Endurance (15), Intelligence (10), Wisdom (6.25) and Luck (10) would not increase.

Step 4 – Gaia’s Blessings (Roll 3 & Roll 4)

Finally the two selected stats for Gaia’s Blessing are considered. Each has a 50/50 chance of a+1 increase.

Choosing Which Stats to Upgrade

Below is a guide on how to optimize the stats you choose for your your hero’s Stat Bonus and Gaia’s Blessing.

-

Hero Profession & Critical Stats

Your hero’s profession determines which stats are the most important to focus on. The following is a list of each profession and the stats that have the greatest impact on successfully performing quests. The higher these critical stats increase, the greater the rewards your hero will receive when performing quests.

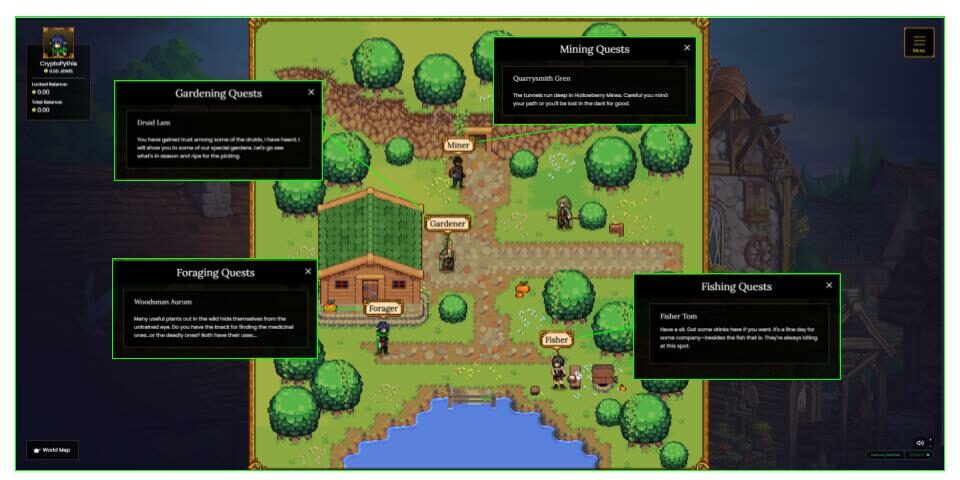

Mining (Strength & Endurance)

Gardening (Wisdom & Vitality)

Foraging (Dexterity & Intelligence)

Fishing (Agility & Luck) -

Compare Profession Stats to Primary Stat Growth Chart

Once you have determined the profession you want your hero to focus on, compare this to the Hero Base Stats – DeFi Kingdoms Google sheet. Using the Google sheet identify your hero’s strengths and weaknesses. The stats that have a high chance of increasing will increase naturally over time as you level up your hero. If your hero’s base and secondary stat growth do not match your hero’s profession, you can use the stat boosts to increase the chances of these stats increasing when you level up.

For example a Knight Forager, needs to increase Dexterity & Intelligence. However, the chance of increasing intelligence is only 20% and Dexterity is 55%. For a knight forager choose Intelligence as the guaranteed stat increase and choose Dexterity for the Gaia’s Blessing and Wisdom as the second Gaia’s Blessing. This means that your heroes foraging stats have a greater chance of increasing, but you may also increase your hero’s strength as as Gardener (because high Wisdom and Vitality (75) could allow the hero to be used for gardening). -

Choose Stats to Boost

Once you have identified your hero’s strengths and weaknesses, you can select the stats you want to focus on to when leveling up. Identify the most critical stats you want to increase and choose these for the guaranteed increases. The next two most important stats and can then be chosen as the Gaia’s Blessing. Using this strategy you have the highest chance of successfully increasing the most important stats for your hero when leveling up.

Step By Step Guide

-

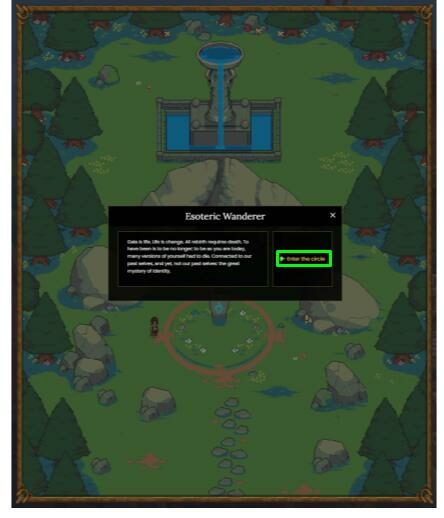

Meditation Circle

To upgrade your hero you must speak with the Esoteric Wanderer in the Meditation Circle. Be sure you have the required Rune Stones, JEWEL and XP or you will not be able to level up.

-

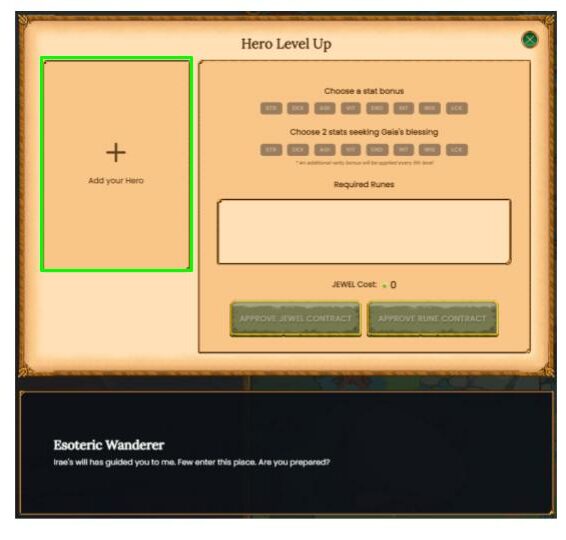

Select Hero

Choose the hero you would like to level up by clicking on the plus symbol. This will pull up your inventory of hero NFT’s.

-

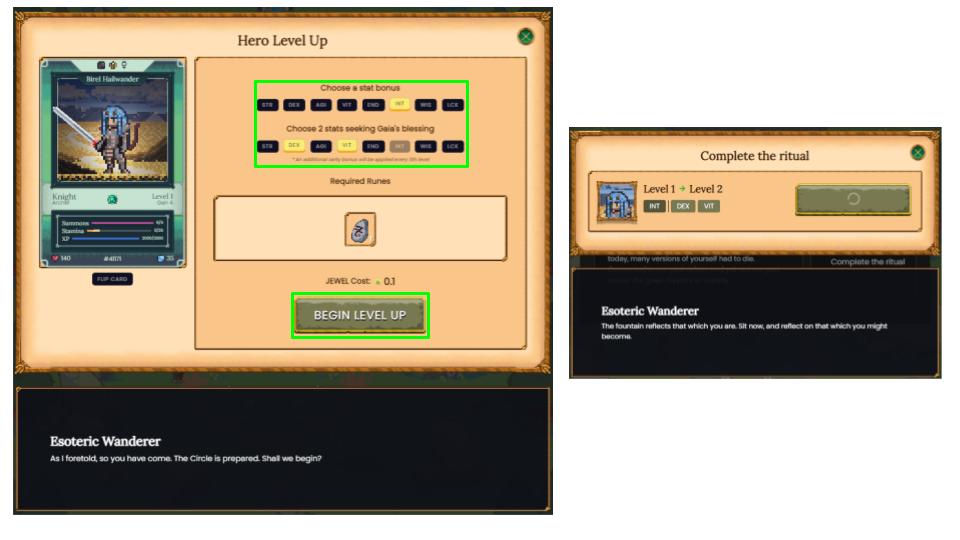

Choose Stat Bonuses

Once you have selected your Hero you can select 3 different stats for the bonus & Gaia’s Blessing. The stat bonus guarantees a +1 increase to that given stat and the Gaia’s Blessing is a 50/50 chance for each stat selected. All three stats must be different.

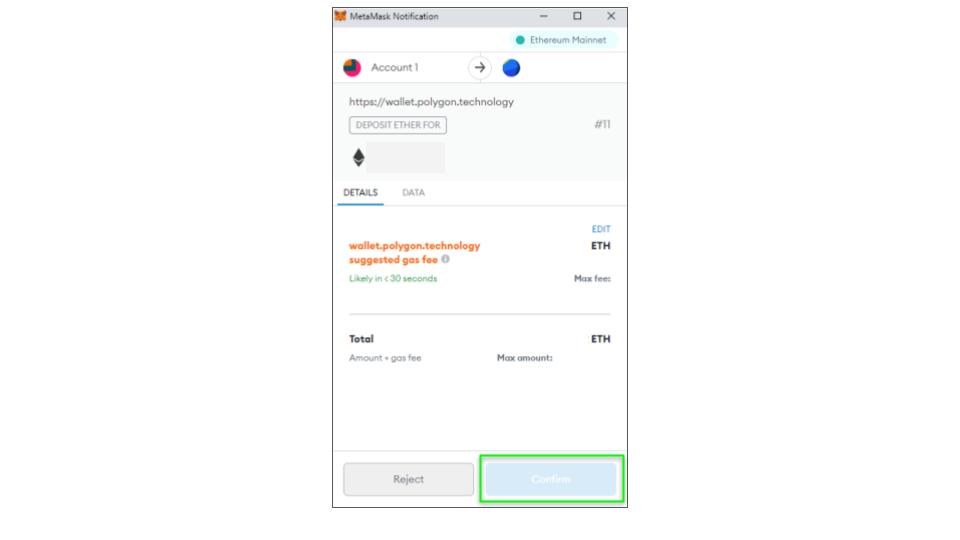

Once you have selected your preferred stats, click begin and approve the transaction in your web wallet.

-

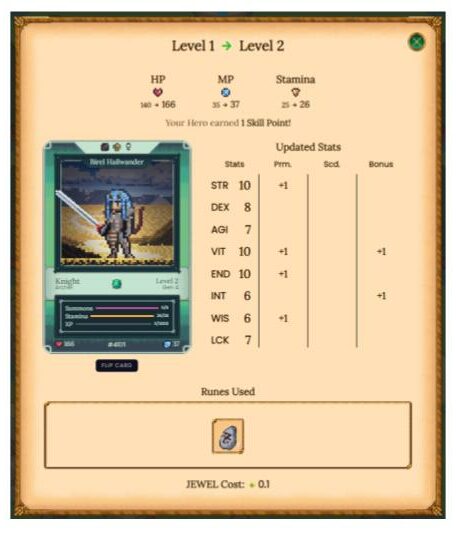

Results

Once the transaction is successful, a chart showing the stat HP and MP increases will pop-up. You have now successfully upgraded your hero.

Gget out there and start questing so you can level up again!

Have you leveled up your DeFi Kingdoms hero yet? Let us know in the comments.

Hi I’m Mike, an active crypto investor DeFi enthusiast and crypto miner. I have been involved in crypto since March of 2021 and in DeFi since May 2021.

I’m also an avid outdoor adventurer!

November 29th 2021| Mike Humphrey

What is overclocking?

Overclocking is when you change the base settings of your GPU in order to increase how fast it performs calculations. By modifying the core clock, memory clock, power limit, and fan speed, you can increase the GPU output. Overclocking will squeeze more performance out of your GPU but it will also produce additional heat. In exchange for increased performance the graphics card will require additional cooling and care.

Is it worth overclocking your GPU?

The benefit of overclocking is additional speed. Gamers and crypto miners who are looking for more out of their hardware take advantage of overclocking to boost performance. For a gamers, overclocking can be a way to extend your budget, allowing you to get higher performance out of a lower end card. With the current GPU shortage and scalpers prices, overclocking may allow you to play that next level game without having to upgrade your current GPU. For crypto miners, overclocking is critical to maximizing card performance while reducing operating costs. It is essential to getting the highest return on your investment and well worth it for any crypto miner.

Is overclocking a graphics card safe?

If done properly overclocking your GPU is safe. When you overclock the GPU you are running it beyond its factory settings, it may void the warranty, and if the additional heat is not managed, it could burn out your GPU. However, if you monitor your graphics card and ensure that it does not overheat, your card will be fine.

Overclocking Software

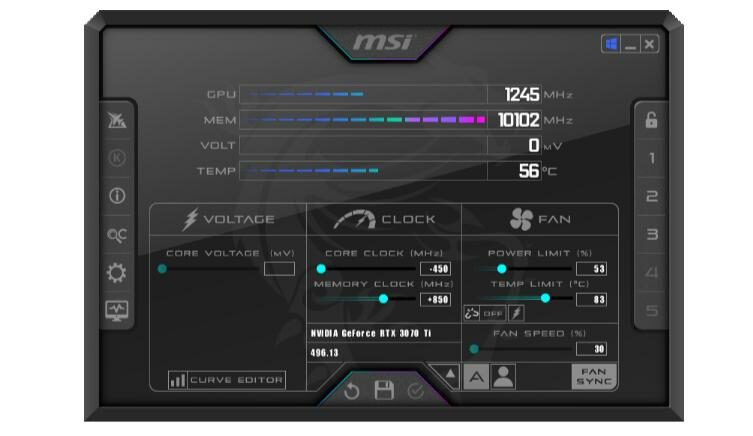

In order to modify your settings, you will need graphics card overclocking software. Many manufacturers provide proprietary software that comes with the card when you purchase. For windows users, we recommend MSI Afterburner.

MSI Afterburner

MSI afterburner is free software offered by MSI. It works on both Nvidia and AMD graphics cards and is the industry standard. It’s highly functional giving you complete control and the ability to monitor changes in real-time.

- NVidia and AMD graphics cards

- Full control of your cards settings

- Monitor in real-time

- Free

Overclock GPU for Mining

Every card and every coin will require different settings for optimal mining. The good news is there is a standard method to follow in order to find the best settings. In the guide below we find the optimal settings for an NVidia 3070Ti (LHR), mining Ergo, using NBMiner. You can follow this exact process for your card with any coin and any miner. If you are new to mining find out how to start mining with Windows.

Note: Overclocking your GPU may void your warranty. If the card overheats, this could also cause damage, please proceed at your own risk.

When you overclock, you will need to make a decision whether you want to optimize for efficiency (hashes per Watt) or if you want to maximize your hash rate. Personally I prefer to maximize my hash rates and then drop the power settings to optimize power usage at maximum rates. The method below will find both and then you can decide which you prefer.

-

Download & Install MSI Afterburner

MSI afterburner is the most popular GPU overclocking software and it’s free. Click on the link above, download and install.

-

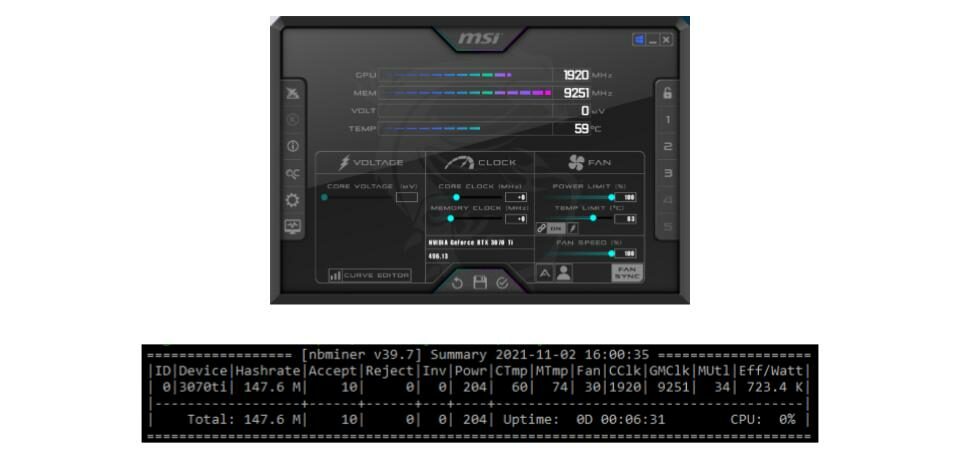

Run MSI Afterburner & Miner

Now that MSI is installed, open it, and start up your mining software. You will need to reference the mining software as you change your the settings in Afterburner.

-

Set Fan Speed To Maximum

The first thing we want to do is set our fan speed to maximum. We do this to make sure that the GPU is properly cooled throughout the overclocking process. Some cards may become quite hot when overclocked and maximizing the fan speed will reduce the chances of damage.

-

Record Stock Hash Rate

Before making any changes, we want to stop and record the stock hash rate, power, and efficiency numbers. When we overclock, we like to open a spreadsheet and record all the results. Download Our Excel Template.

-

Optimal Efficiency (No Overclock)

There are some cards that actually mine better with stock settings. Our first step will be to check what impact decreasing the power has on base hash rates and efficiency. Later, we will compare this to the efficiency at our maximum hash rate. To do this we decrease the power by increments of 10%. Between each decrease be sure to wait for the hash rate to settle before recording it.

The table below shows the results for our 3070Ti. We excluded the results between 80% and 50% as they were redundant.

As the power was decreased, hash rates actually started to slowly increase until we hit 60% power. Between 60% and 50% hash rates and efficiency started to drop off. After some trial and error we found a maximum efficiency and mining rate at a power setting of 51%. Make sure to record your efficiency and hash rates before moving to the next step.

-

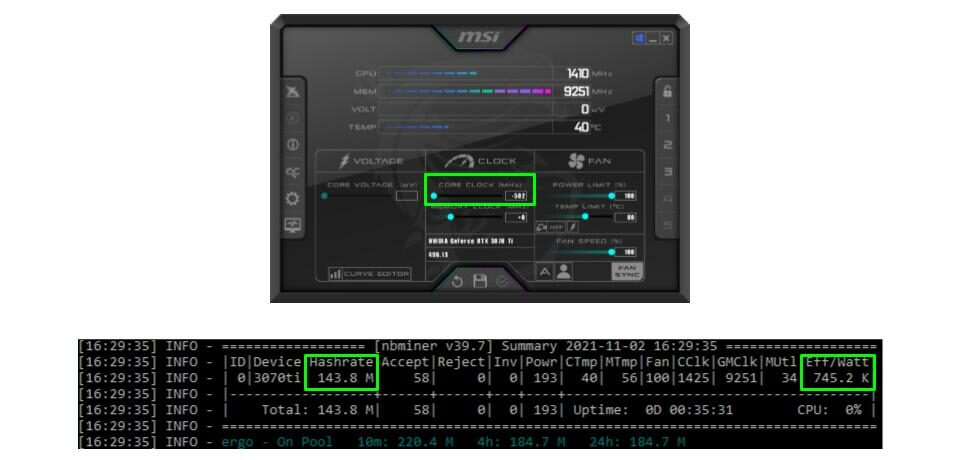

Core Clock Speed

To check the core clock, first reset power to 100% (we don’t want to limit the card in any way). We then want to set the core clock to the lowest setting possible. (Some cards mine better at low clock rates). If you see a spike in hash rates when you decrease the clock, slowly increase it by increments of 100 until you find the maximum hash rate. If there is no change in hash rate at low clock settings, you can start incrementing from 0 clock speed.

For our 3070Ti, there was no increase to hash rates at a low clock speed. So we proceeded to increase from 0 by increments of 100. Some cards are more sensitive to changes in clock speed, and you may need to go by increments of 50. The table below shows the results of our tests.

Our card showed a small increase in mining rate as we increased the core clock and then crashed at 300. We pulled the core clock back to 200 which seemed to stabilize the card.

-

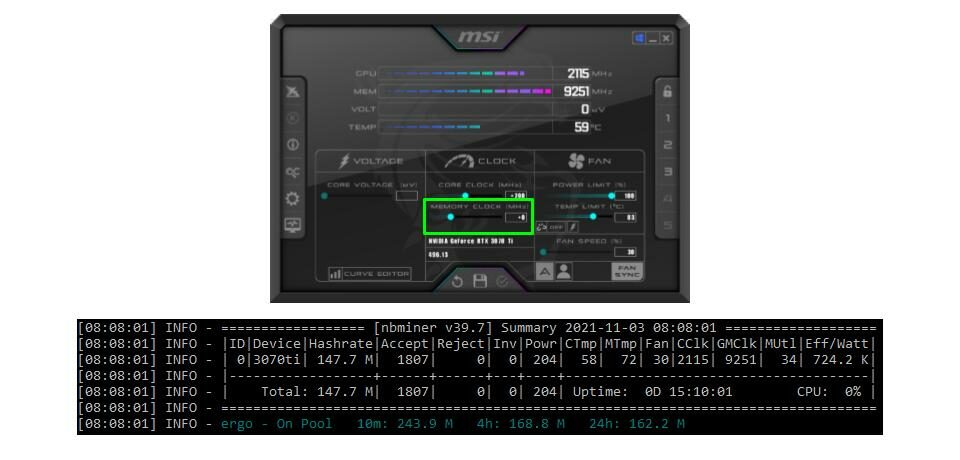

Memory Clock Speed

Now that we’ve determined the optimal clock speed, we can focus on the memory speed. Starting from zero, incrementally increase the clock speed by 50 or 100 until the hash rate start to drop off or the miner crashes.

Our 3070Ti maxed out its hash rate at a memory clock speed of 1425.

-

Reduce Power

Now that we have optimized the core and memory clock for mining rates, we can look at reducing the power usage to optimize efficiency. To do this, we incrementally decrease power by 10%. When the mining rate starts to drop off, pull the power back up and decrease the size of the increments until you find the optimal power settings. We usually find the lowest optimal setting and then bump the power up by a couple of percent to ensure that the card has some room and will not be power limited.

As you can see from the table the hash rate dropped off significantly at 60%. We pulled the power back up to 65%, but hash rates didn’t increase. The power was reset to 70% and decreased by 1% increments until 68% was identified as the optimal power setting.

-

Results

Overclocking the card increased hash rates by 30 MH/s and efficiency by 200 Kh/Watt from factory settings.

Here you must make a descion which settings you prefer, maximum efficiency or maximum hash rate. We chose maximum hash rate settings.

-

Save Your settings

Now that we have the optimal overclock settings, you can return the fan setting to auto and save the presets in Afterburner. To save the settings click on the disk icon in the bottom middle and then click on a number on the right hand side. Each number can save different settings.

You can also add MSI Afterburner to the Windows startup folder so that your overclock settings will take effect automatically when Windows restarts.

-

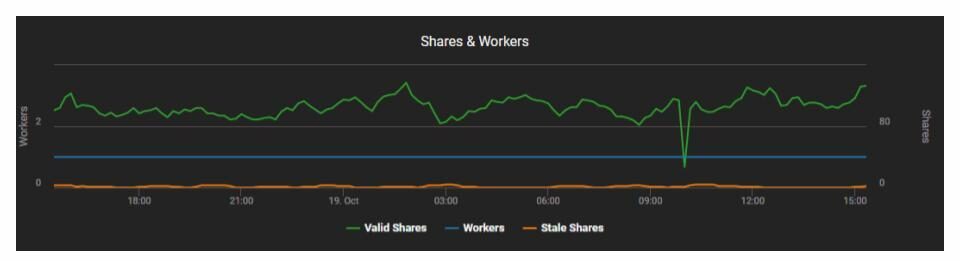

Check Stability

When you overclock a GPU, it pushes it beyond its factory limits and can cause the card to become unstable. Make sure to check the stability of your card over the next couple of days. Watch out for the mining software crashing, or an increase in the number of invalid shares. If there are signs of instability, you can dial back the settings and let the card run again. Repeat the process until you find the best stable settings.

Have you overclocked your GPU? Tell us your GPU, coin, overclock settings, and hash rate in the comments.

Hi I’m Mike, an active crypto investor DeFi enthusiast and crypto miner. I have been involved in crypto since March of 2021 and in DeFi since May 2021.

I’m also an avid outdoor adventurer!

December 1st 2021| Mike Humphrey

What is Defi Kingdom

DeFi Kingdom combines gamified yield farming, with classic console game graphics. Jewel, the in-game token is earned by providing liquidity to pools as well as staking. Where it differs from a normal swap protocol, is the in game NFTs (heroes and land), whose attributes help you to earn more yield. NFT heroes, and land are used to undertake quests and even PvP games to level up, increase their stats, and increase your rewards.

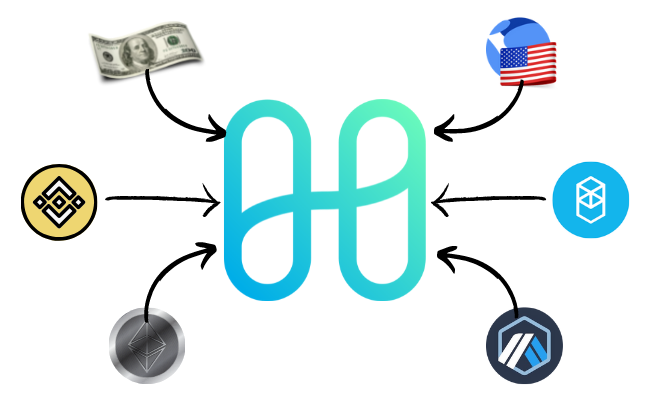

Transfer Funds to Harmony

In order to play Defi Kingdom you will need to have assets on Harmony. To transfer funds over to Harmony you can use the Harmony Bridge, Terra Bridge, Synapse Cross Chain Bridge, or Anyswap. You will also require a small amount of ONE token (the gas token for Harmony). Read our guide on how to Transfer funds to Harmony. Harmony is compatible with Metamask. Read how to Add Harmony to Metamask.

Create Your Profile

The first time you log into DeFi Kingdoms, you will be asked to create a username and select and avatar. Click on the play button and give permission for the site to connect with your wallet.

A new window will open where you will enter your username and select your character avatar.

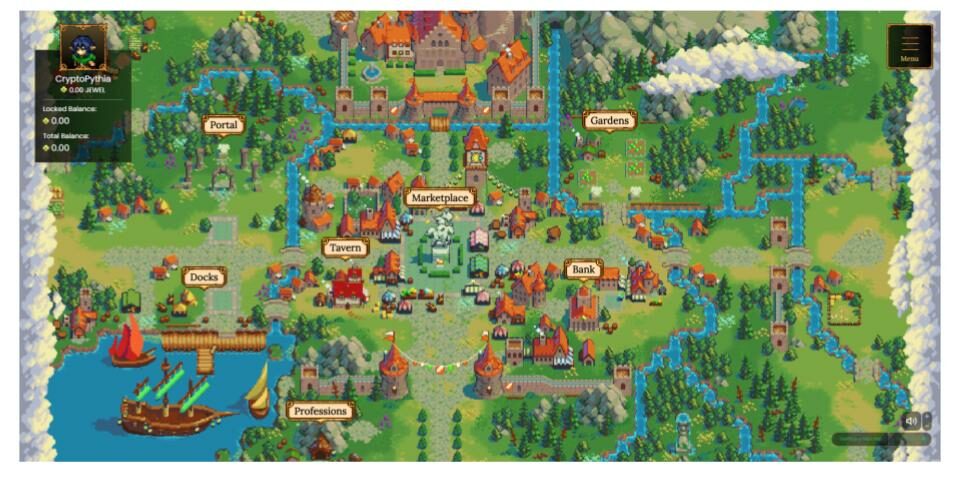

Navigating The Kingdom

Once you have created your character, you are ready to start exploring the world of DeFi Kingdom.

-

-

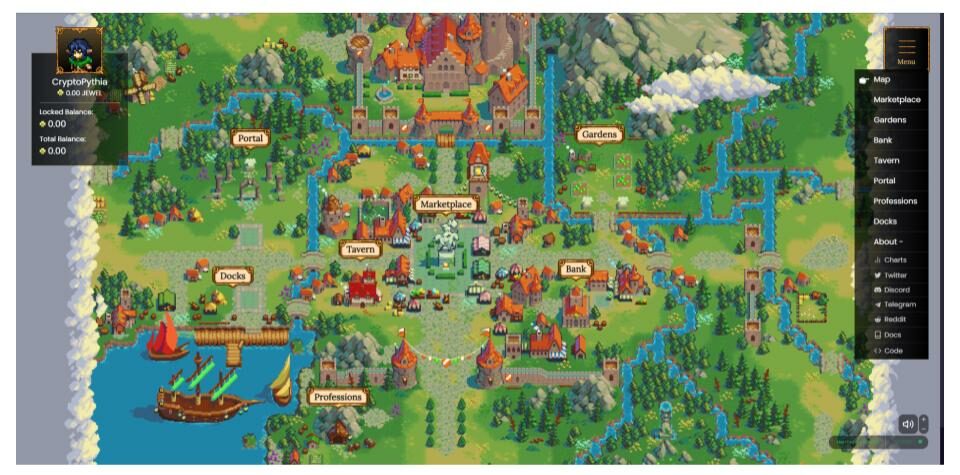

World Map

The world map is the starting point for your journey through the kingdom. Each area is identified on the world map with a sign. To navigate from one area to another you can click on the signs, or use the menu in the top right.

The menu allows you to quickly move from one are to another without having to go back to the world map. From the menu you can also access external links to statics, docs and various contact channels. As the game grows, the world map will continue to expand and new areas will open up. Now that we have an idea of how to get around in the game lets explore what you can do in each of the areas.

-

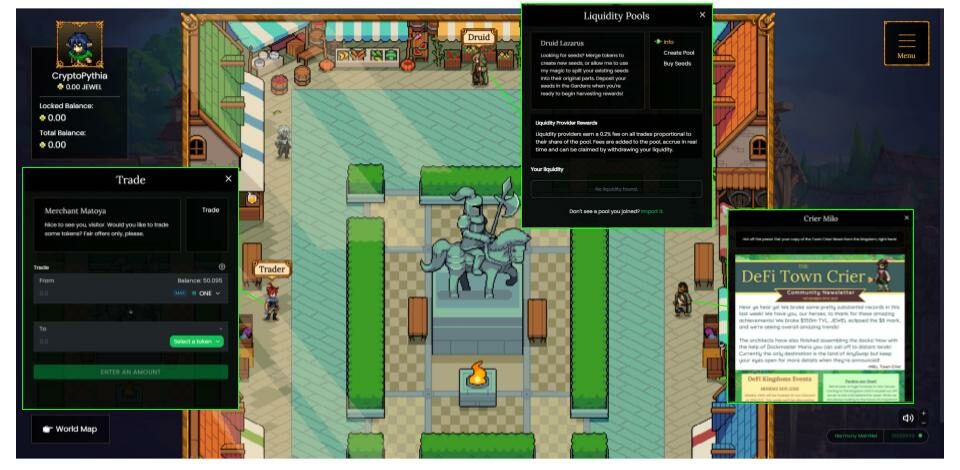

Market Place

The Market Place is the center of DeFi Kingdom. Here you can exchange tokens, deposit them in liquidity pools, and catch up on the “local” news.

There are three NPC’s in the Market Place:

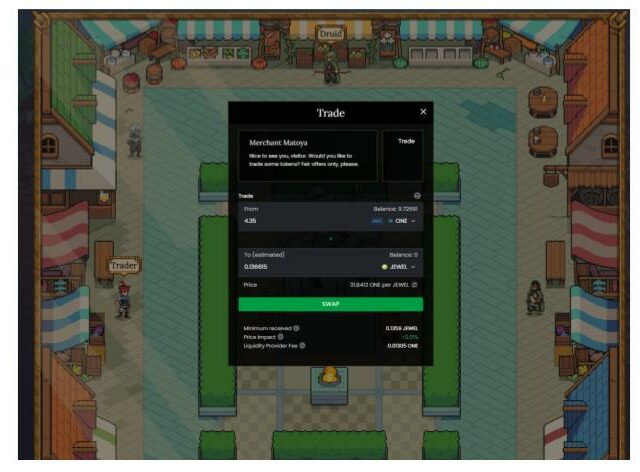

- Trader: Allows you to swap tokens

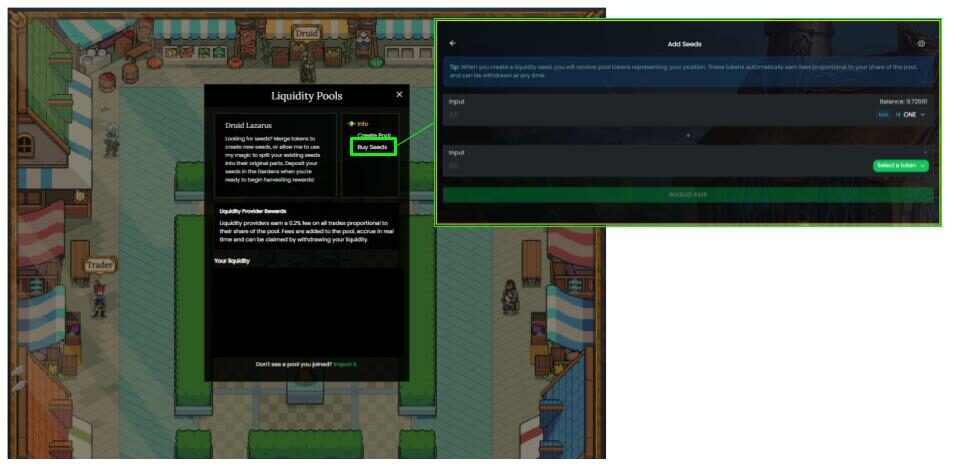

- Druid: Pool creation or Deposit your tokens into a pool

- Town Crier: Information and updates about DeFi Kingdom

-

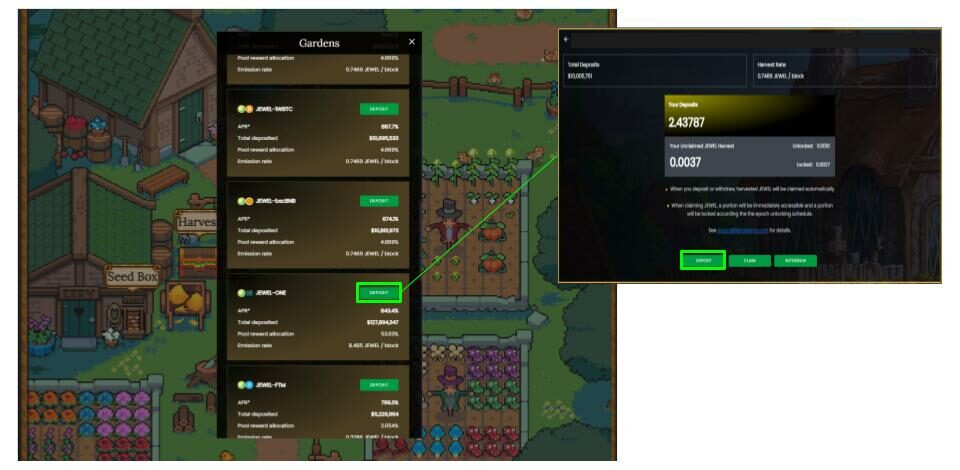

Gardens

The Gardens are where players can farm liquidity pool (LP) tokens for Jewel. To deposit your LP tokens (called seed in the game) you must put them in the Seed Box. Jewel rewards are collected from the Harvest Box.

-

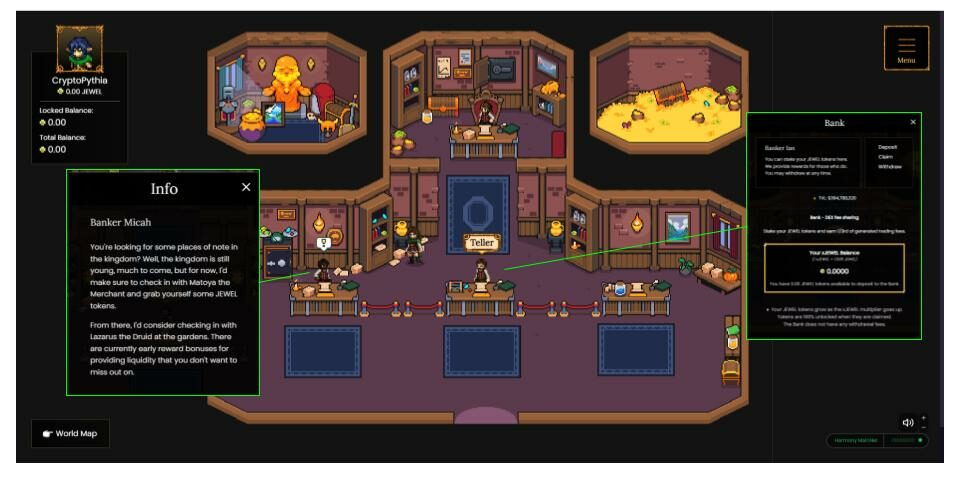

Bank

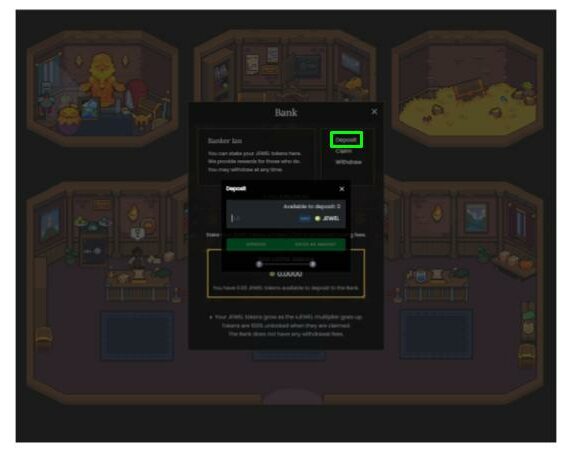

At the Bank players can stake their Jewel in the protocol and receive a portion of the platform trading fees. When Jewel is deposited, you will receive xJewel in your wallet. As fees accumulate in the protocol, xJewel increases in value. When you withdraw xJewel, you receive the Jewel you deposited plus the accumulated fees.

-

Tavern

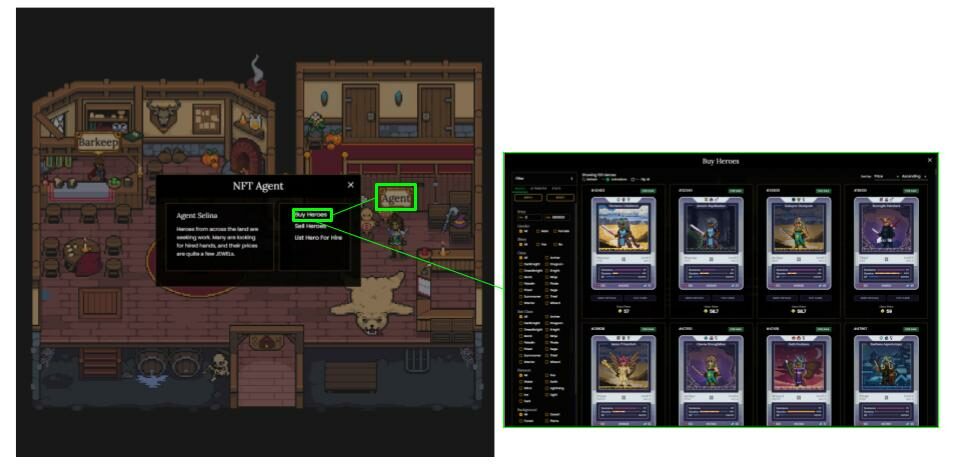

The Tavern is the gathering place of heroes (in-game NFT’s). In the tavern you can purchase, rent, and research DeFi Kingdom heroes. The Barkeep has an inventory of searchable heroes, and also allows you to send heroes to other users. The NFT agent is the marketplace for purchasing, selling, and renting heroes.

-

Portal

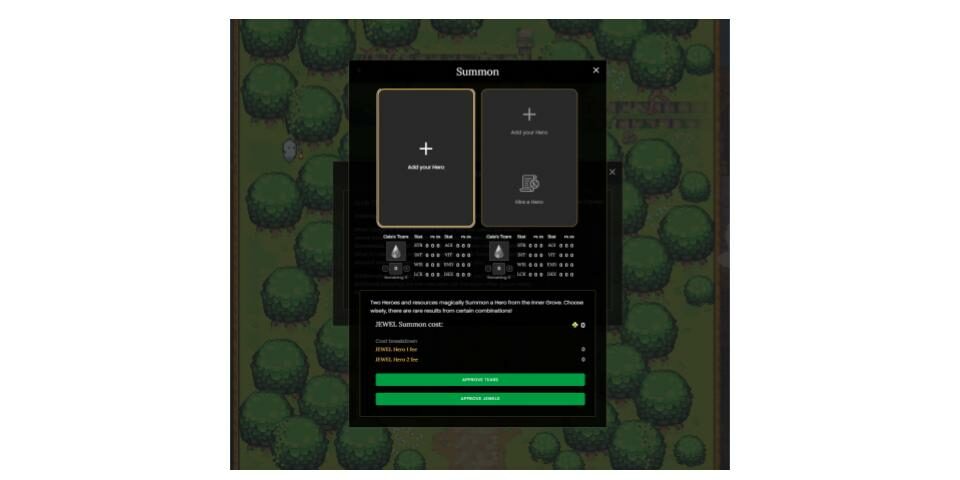

The Portal is used to summon/create new heroes/NFTs. Using Jewel, Tears and 2 heros, you can create new NFT.

-

Professions

Professions, is where your hero goes to perform quests and activities. In exchange for taking on the quests you will receive Jewel. There are four professions available – fishing, gardening, foraging and mining. Quests are scheduled to go live in Q4 of 2021.

-

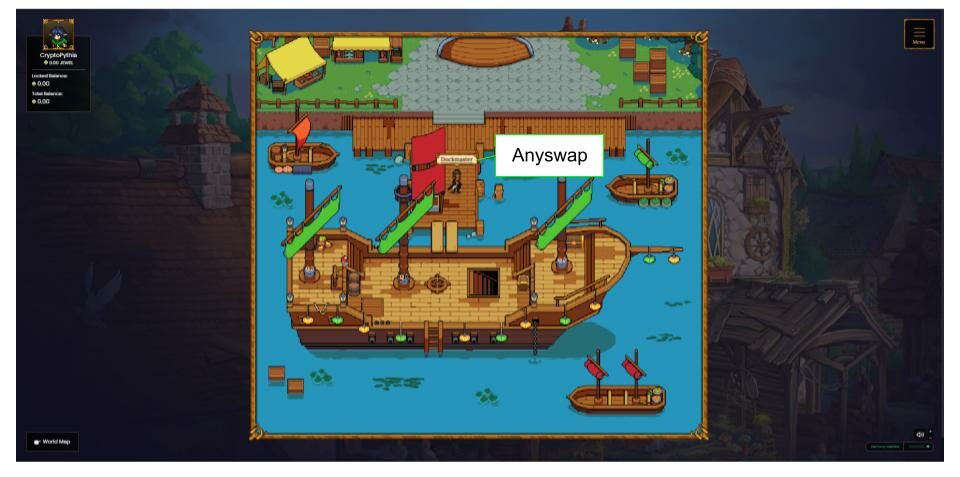

Docks

The docks is where you can leave DeFi Kingdom and go to another blockchain. Clicking on the Dockmaster will take you to Anyswap where you can exchange your Harmony tokens for tokens on another blockchain.

-

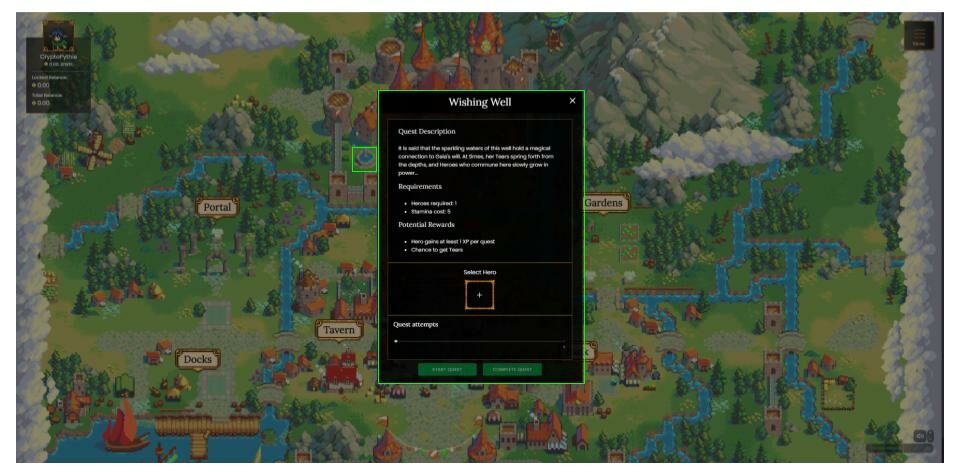

Wishing Well Quest

The Wishing Well is a quest, that allows you to collect tears (required to summon new heroes). You must have a hero NFT in order to complete the quest.

-

How to Play DeFi Kingdoms

The following is a quick guide on how to get started with DeFi kingdom. Before starting be sure you already have funds transferred to Harmony, and ONE token in your wallet. At it’s heart DeFi Kingdoms is a swap protocol, similar to Sushi Swap or Viper Swap. To earn Jewel rewards, you must deposit liquidity in a pool and then stake your liquidity pool tokens. Jewel can then be used to purchase in game items.

-

-

-

Choose a Pool

You first stop in Defi Kingdom should be to check which pool you want to provide liquidity to. To do this head to the Gardens and click on the Seed Box. A window will open showing you all of the liquidity pools available and their APR. Choose a pool that you feel has the best returns with the lowest chance of impermanent loss. Impermanent loss occurs when the relative price two tokens in a pool fluctuates disproportionately. Before investing your tokens, be sure to do your own research and understand the risks involved.

-

Exchange Your Tokens

Now that a pool has been selected, head to the Market Place to exchange tokens and add them to the liquidity pool. In the Market place, speak with the trader and exchange your tokens so that you the two pool tokens in a ratio of 1:1.

In the Example above, I have swapped half of my ONE tokens for Jewel (leaving some ONE in my wallet for gas fees). This will allow me to put in equal amounts of ONE token and Jewel token into the liquidity pool in the next step. Click swap, approve the tokens and then approve the transaction. (see our guide on keeping Metmask safe)

Once you have exchanged your tokens, speak to the Druid and deposit the tokens into a liquidity pool. You will need to deposit tokens in a 1:1 ratio, where the value of each token deposited is equal (for example 4.35 ONE: 0.138815 Jewel as seen in the swap above). Once deposited you will receive LP tokens for the pool. This represents the portion of the pool you own.

-

Stake LP Tokens

Read about the DeFi Kingdom tokenomics below before depositing your LP tokens. There are restrictions for withdrawing staked LP as well as locked rewards with vesting schedules. To stake your tokens and earn additional Jewel rewards, head back to the Gardens. Click on the Seed Box and select the liquidity pool with your given token pair and choose deposit.

DeFi Kingdom Tokenomics

DeFi Kingdoms has developed several strategies to reduce the volatility of the Jewel token and to protect the longevity of the ecosystem.

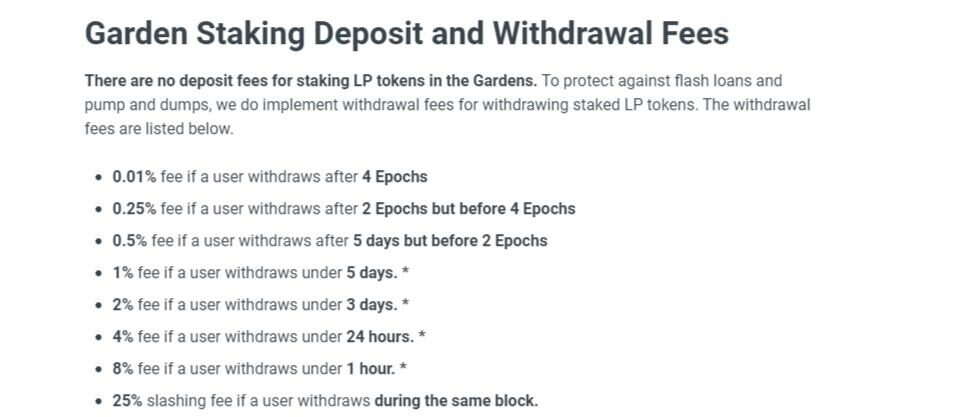

LP Staking Withdrawals

To prevent flash loans and pump and dump strategies, DeFi Kingdoms has implemented a withdrawal fee schedule. If you withdraw your LP within the same block it was deposited, there is a 25% fee on the withdrawal. The fee decreases progressively down to 0.01% at roughly 1 month. See the table below for the complete fee schedule.

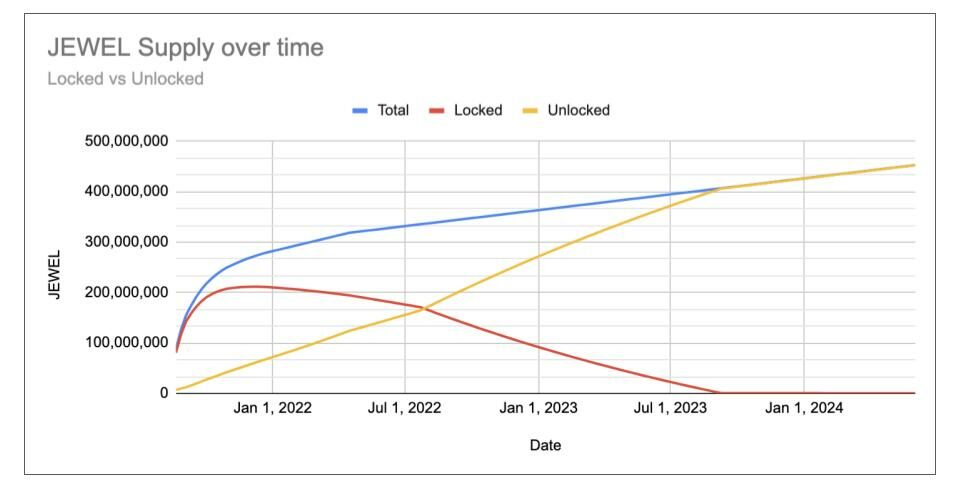

Locked Jewel & Vesting Schedule

Staking rewards have two components – locked, and unlocked Jewel. Locked Jewel begins vesting in January of 2022. The percentage of your rewarded Jewel that is locked decreases over time. For example at Epoch 1, 95% of the rewarded Jewel was locked. At Epoch 2, 93% of the rewarded Jewel was locked. The percentage of locked Jewel decreases by 2% every Epoch (approximately 1 week). This strategy prevents the supply of Jewel from spiking in the market and helps to maintain the token’s value.

-

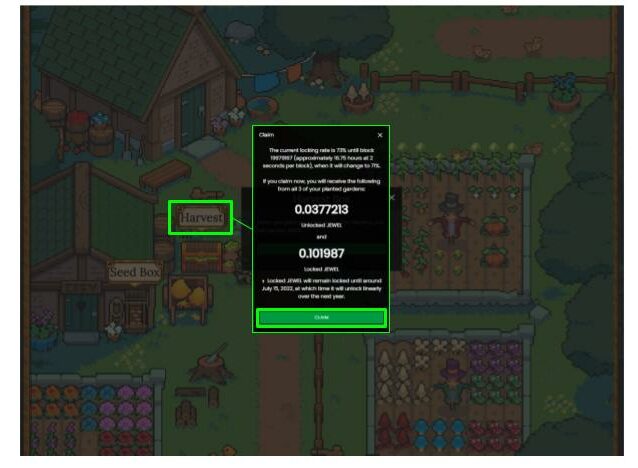

Harvesting Rewards

As Jewel rewards start to accumulate you can withdraw the unlocked Jewel from the Garden Harvest Box. Click on the Harvest Box and click claim. Claimed Jewel can either be re-invested into one of the liquidity pools, deposited in the bank to receive xJewel, or can be used to purchase in game items.

-

Stake Jewel in the Bank

To earn additional rewards as you accumulate Jewel, you can deposit it in the Bank. Players who deposit Jewel into the bank receive a distribution of 1/3 of all trading fees on the platform. When you deposit Jewel, you receive xJewel in your wallet, which increases in value based on the platform trading fees. To deposit your Jewel, speak to the Teller at the bank and select deposit. Select the amount of Jewel you wish to put in and approve the transaction. xJewel will now appear in your wallet.

When you are ready to use your Jewel, you can head back to the bank, speak to the teller, and select withdraw. -

Purchase Your First Hero

When you have enough Jewel, you can purchase your first hero from the Tavern. Speak with the agent to see a list of all the heroes currently available. Select The Hero you wish to purchase, approve the Jewel and the transaction.

-

Summoning A New Hero

To summon a hero, you will need 2 heroes, some Jewel, and Tears. Go to the portal and speak with the Arch Druid, and create a Summoning Crystal. Select the two heroes and approve the required Jewel and Tears. Once you have infused a Summoning Crystal speak with the Summoner and a new hero can be created.

-

-

What’s Coming

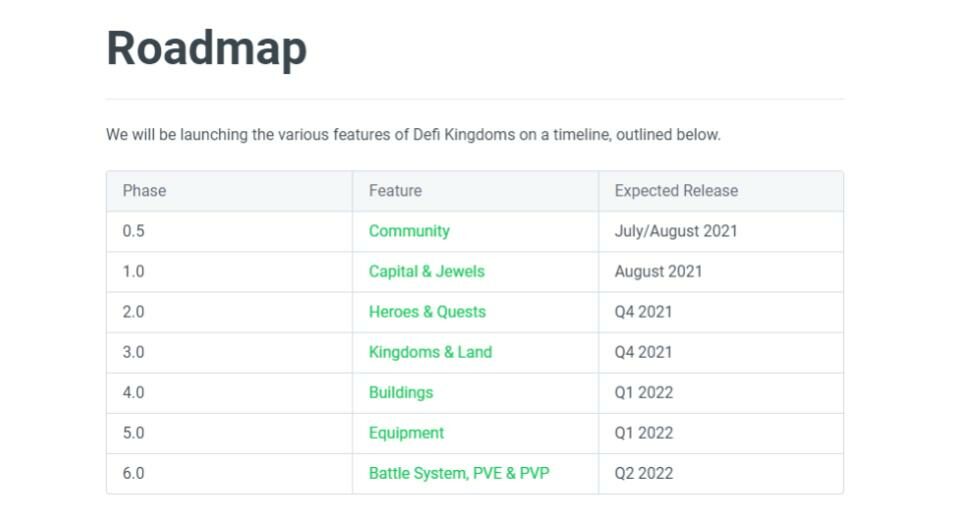

DeFi Kingdoms is still quite new and there are some exciting advancements on the way. So what is next for the game? DeFi Kingdoms is set to expand the NFT’s available with land to be introduced. Quests are under development and they will allow heroes to begin leveling up, which will increase player rewards. There is also PvP and PvE game play scheduled for release in 2022. Below is the roadmap from the developers.

Have you played DeFi Kingdoms yet? Let us know in the comments

Hi I’m Mike, an active crypto investor DeFi enthusiast and crypto miner. I have been involved in crypto since March of 2021 and in DeFi since May 2021.

I’m also an avid outdoor adventurer!

November 22nd, 2021| Mike Humphrey

How to Invest in Cryptocurrency

Crypto investing can be as simple as buying a coin and watching it grow, or it can involve multi-tiered investment techniques that include leveraging your crypto to increase your rewards. Below are some ways to get your cryptocurrency working for you. Lets take the red pill and see how deep the rabbit hole goes.

Buy and Hold Crypto

Buying and holding is one of the most basic techniques for making money on your crypto. It is a pretty passive strategy and involves selecting a coin or token that you believe will succeed in the long run. Holding cryptocurrency for the appreciation can have huge returns. For example Bitcoin’s 10 year compounded annual return is 200%, that outperforms the average annual return of the stock market (10%) by 20x. If you are more comfortable with risk, you can consider altcoins (coins other then Bitcoin). SHIB for example has grown 7.7 million % since it’s inception. If you are good a picking winners, buy and hold can be a great hands off strategy. With big returns though, comes big risk. Altcoins are similar to penny stocks, winners can win big, but there are lots that don’t win, especially in cryptocurrency where the barrier to entry for new coins is quite low.

Buy and Hold Strategies

Dollar Cost Averaging (DCA)

Dollar cost averaging is a technique where you purchase an asset at consistent intervals. Many cryptocurrency platforms will set up automatic purchasing for you, making this a very easy hands off strategy to follow. Dollar cost averaging levels out your purchase price. Over the long-run this allows you to take advantage of gains without being impacted by price fluctuations. This is especially important with volatile assets like cryptocurrency where prices can fluctuate by +/- 20% a day(or more…).

Buying Winners

Buying the winners involves identifying the top assets that have increased the most within a given time frame. The idea, is that these assets have momentum, that you expect to continue. By purchasing the winners you are looking to continue to ride the wave. This strategy can be combined with dollar cost averaging.

Buying Losers

To purchase losers, you identify the lowest performing assets in a given time frame. The idea behind this strategy is to purchase an asset at a low price, with a large potential upside. You may be lucky enough to find a diamond in the rough.

There are many more possible strategies. We recommend if you are going to buy and hold, that you use dollar cost averaging with all of these.

Trading Crypto

One step up in complexity from the buy and hold strategy is trading crypto. With this strategy your goal is to buy low and sell high, or sell high and buy low. Investors experienced with day trading in the stock market will be familiar with this investment technique. To better take advantage of the market, you can consider looking at short selling and options trading. Being a very volatile market, trading can offer opportunities for investors who use strategies that depend on price fluctuations. There are significant opportunities in cryptocurrency for experienced traders.

DeFi

All of the above strategies can be performed on exchanges. These exchanges are usually a combination of Fiat/crypto where you use fiat to purchase and sell cryptocurrency. The strategies below involve smart contracts, where you allocate your assets to a protocol, and in exchange earn a return. Read our article about DeFi to learn more.

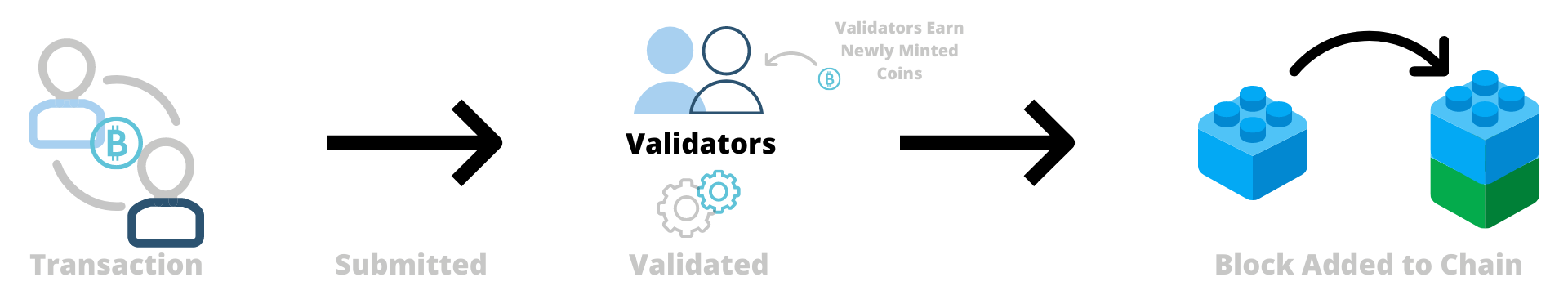

Staking (PoS)

In terms of complexity, staking is the first level in DeFi. Proof of stake blockchains (Ethereum and Cardano) offer opportunities for investors to earn rewards for putting up their cryptocurrency to be used to verify the block chain. This involves loaning your cryptocurrency to the blockchain for a set period of time. Your assets are locked into the proof of stake protocol and used to verify transactions on the blockchain.

Staking Ethereum

Staking Cardano

DeFi Returns

The world of DeFi is a very dynamic place, with new protocols being developed every day. The main premise behind DeFi is lending and borrowing assets to provide liquidity to protocols. In return investors earn a return on their liquidity.

Lending & Borrowing Platforms

lending & borrowing applications are central platforms for the DeFi space. You deposit your assets into the protocol and earn an interest on your deposit. You can then borrow against these assets, either in the same currency or in another currency offered by the platform. You are required to pay interest on your borrowed asset which is secured by your deposit. If the loaned asset reaches a threshold value versus your deposit, either due to interest accumulation or price fluctuation, then your position will be liquidated.

Liquidity Pool Swap Fees

Liquidity pools provide coins for swap protocols. In order to exchange from one coin to another you must find someone to trade with. Traditionally in centralized finance you would do this at a bank. In DeFi, swap protocols have pools of coins that have been provided by third party users. When you wish to exchange, the swap protocol takes your coins and gives you a different coin from the pool and charges a small fee for the service. Investors who have added coins to the pool receive a portion of those fees as a reward. Liquidity pools can be highly lucrative, but due to their nature are subject to impermanent loss.

Native Token Rewards

Protocols offer native tokens that provide additional return for users who have added liquidity. The goal of the protocol is to increase liquidity to a point where the platform can become large enough that it is ubiquitous. As rewards are distributed it decreases the value of the native token, meaning the rewards are deflationary and not sustainable in the long-run. Often native tokens can be staked in the protocol to give the owner governance rights. Native tokens are often used in yield farming strategies and then exchanged for stable coins or Eth/BTC.

Protocol Fees

Protocols create non-governance tokens that can be staked to receive a portion of the platform revenue. The tokens can be purchased or received as rewards, and are then staked back in the protocol. This provides the protocol with additional funds and in return the investor gets a share of the revenues.

Arbitrage Opportunities

Liquidity pools depend on arbitrage. Token prices in a pool are regulated by users exploiting price differences between the pool and actual market rates. By their very design, they present investors with the opportunity to capitalize on price differences. There are a few protocols that allow investors to automate and take advantage of arbitrage opportunities.

Options Protocols

Options protocols function the same as options do in a centralized market. Put or call options can be purchased based on the expected future value of an underlying asset usually Bitcoin or Ethereum. Two protocols that offer option trading in DeFi are listed below.

Insurance Protocols

Insurance protocols offer users the ability to insure their funds against unforeseen circumstances. They can be used to insure specific tokens, or even tokens in specific protocols. Insurance providers require liquidity to cover insurance claims and users who provide liquidity earn a portion of the fees paid by insurers.

Conclusion

Cryptocurrency is an exciting place, the speed of the changes happening, especially in DeFi is astounding. Cryptocurrency is so much more than just an asset to hold or trade for a profit. For those interested in taking the time to learn, and become comfortable, there are great returns to be had. Be forewarned, DeFi is still the wild west. With new advancements comes risk. Be sure to do your own research before investing in any project!

How are you investing in crypto? Let us know in the comments.

Hi I’m Mike, an active crypto investor DeFi enthusiast and crypto miner. I have been involved in crypto since March of 2021 and in DeFi since May 2021.

I’m also an avid outdoor adventurer!

November 1st, 2021| Mike Humphrey

What is Crypto Mining?

Crypto mining is a proof of work (PoW) method of verifying transactions on a block chain. Whenever a transaction is submitted, a cryptographic hash equation is sent to miners. Computers are then used to find a solution to the equation. When a computer successfully solves an equation a data block is “verified” and can then be added to the block chain.

Solving hash equations is similar to rolling a set of dice and trying to hit a specific number. Computers must randomly attempt to find the correct inputs for the hash equation that will result in a given output. The computer tries different inputs over and over again until it gets the correct solution. The faster and more often a computer can input and solve the cryptographic hash equation the more likely the computer will land on the correct number. How fast your computer can “roll the dice” is called your hash rate.

How To Make Money Mining Crypto

There are two ways to make money while mining crypto, through block rewards and transaction fees.

Block Rewards

Block rewards are set by the blockchain. When a transaction is performed a new block is created and it is sent to miners to solve. Every time a new block is solved and added to the blockchain new coins are minted and rewarded to the miner who successfully solved the block. The reward pays miners for allowing the blockchain to use their processing power to verify and secure the blockchain.

Transaction Fees

Transaction fees are paid by the person sending crypto currency, to move a waiting request higher up in the cue. The higher the transaction fee the sooner the request will be completed.

Note: Not all mining pools share transaction fees with miners. Read out article on mining pool payout methods to learn how pools distribute earnings to miners.

How Much Can you Make Mining Crypto

If you have a top of the line video card you could be earning $10-$15/day mining Ethereum (dependent on power and Eth price). If you have a lower end card you could be looking at $2/day. Many miners are focused on mining Ethereum because it is currently the most profitable coin (see our article on Top Websites for Cypto Miners). Also if you mine Ethereum and learn about De-Fi you can take your mining profits and re-invest them to earn interest.

How To Mine Cryptocurrency On PC

-

Choose a Coin

Choosing which coin to mine to is the first step. Different coins have different algorithms and also different blockchains. This means that different coins may require different miners, and different wallets. If you don’t have a wallet yet or are not sure which coin you want to mine read our article about crypto wallets. You can also check out the Whattomine website to find out which coin is the most profitable.

-

Choose a Mining Pool

Mining pools allow miners to work together to verify blocks. The difficulty level on most blockchains makes it unrealistic for a single miner to solve a block on their own. By pooling your mining power with others, you can find blocks together and then split the rewards. Each pool will have different payout types, fees, locations, and size; all of which should be taken into account when choosing. To make things easier until you get a handle on how everything works, select the pool closest to you, with the lowest fees and a PPLNS+ payout. Read more about how mining pools work and how to choose a mining pool.

-

Choose a Miner

A crypto miner is software that will allow your computer to receive, solve, and submit hash equations from a mining pool. Some mining software allows you to mine different types of coins and may also have additional features to optimize mining for your specific computer e.g. LHR card workarounds etc.

-

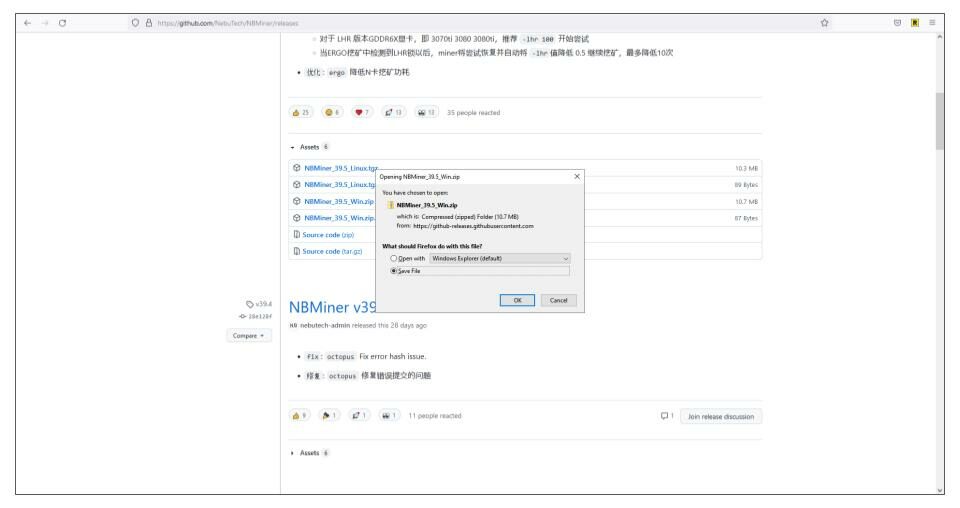

Download Miner

Below is a list of several miners to choose from with links to their download pages.

-

Install Miner

-

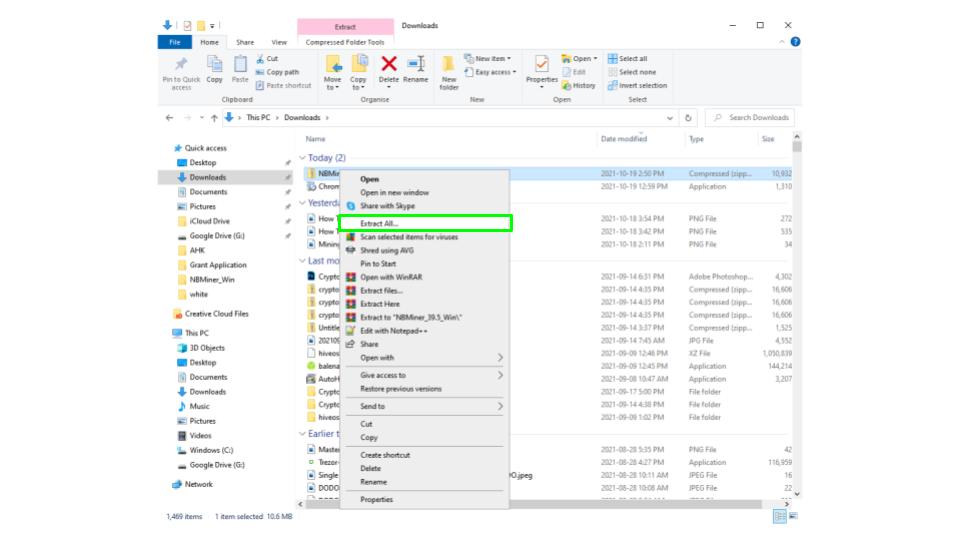

Extract

After downloading the miner file, the next step is to extract the miner. I usually extract the folder to the desktop so I can find it easily.

-

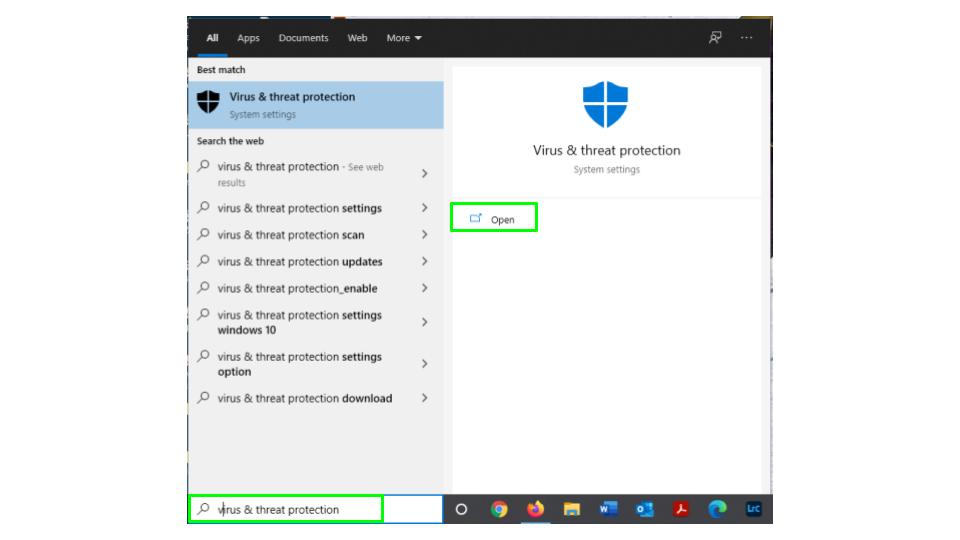

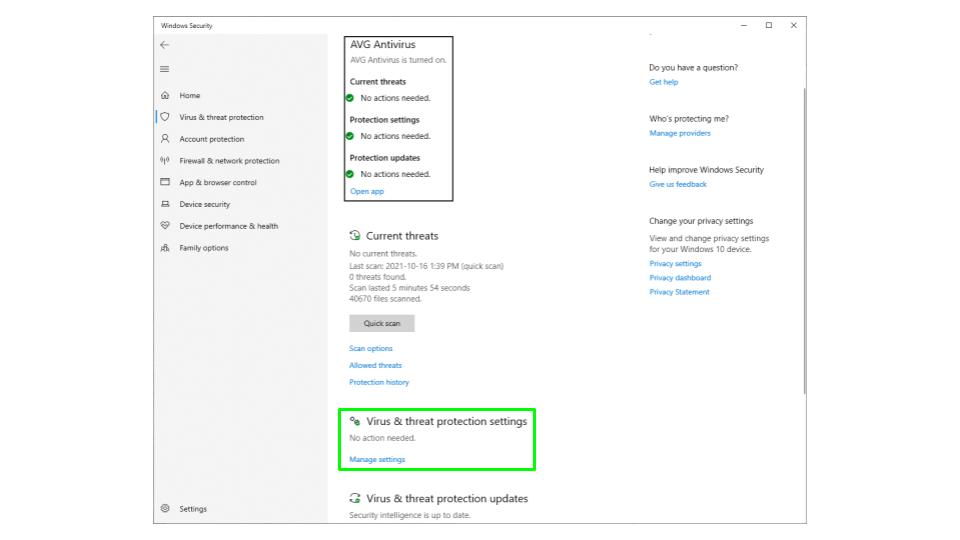

Add Windows/Anti-Virus Exceptions

Mining software is often identified as a virus by Windows defender and anti-virus software. You will need to create an exclusion for the new folder you have extracted.

-

-

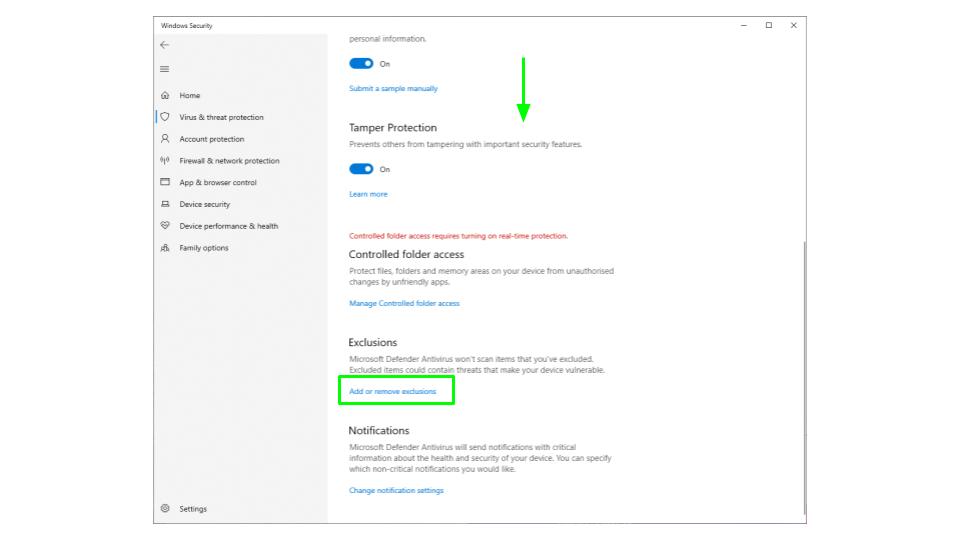

Open Virus & Threat Protection

-

Manage Virus & Threat Protection Settings

-

Scroll Down in To Exclusions and Click Add or Restore Exclusions

-

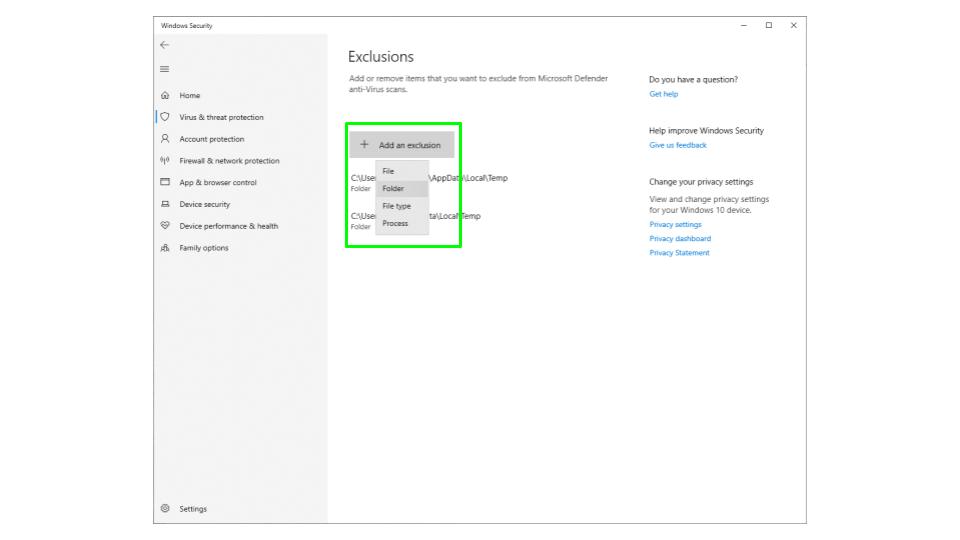

Click on Add an Exclusion and Choose Folder

-

Add the Folder You Just Extracted

-

-

-

-

Update Bat file

A Bat or Batch file is a list of instructions that will tell Windows to run the miner. It also tells the mining software which mining pool you wish to mine to, the wallet you want to deposit to, and, any other special instructions required for the miner.

The easiest way to setup a batch file is to look at the example batch files included with the miner, and update them with your information.

Information Needed

- Crypto Wallet Address

- Mining Pool Address and Port

- Name For Your Rig

For our example we will set up NBminer, mining Ethereum on the Ethermine US Pool. (Download NBMiner Here)

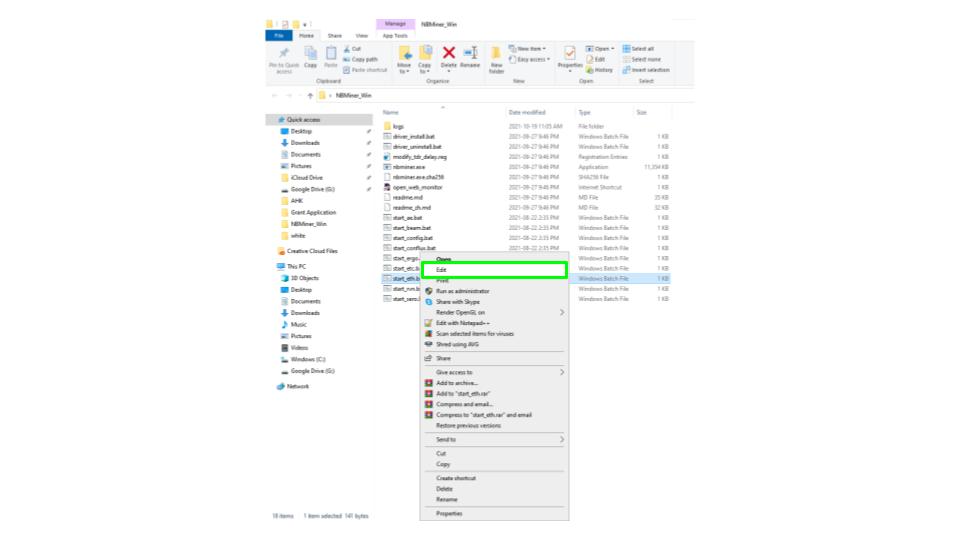

Open the miner folder find the eth_start.bat file, right click and select edit.

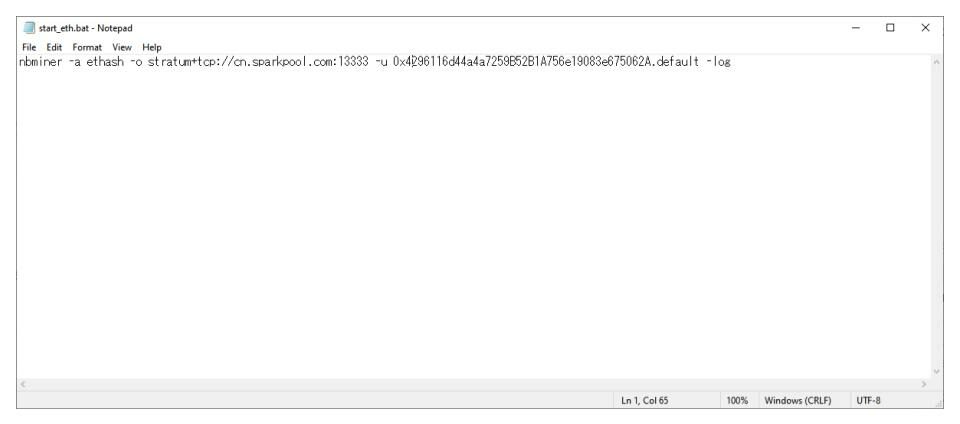

The file will open in a text editor and will look something like this.

To modify this file we need to change the pool address, wallet address, and name your mining rig. The syntax for batch files changes depending on the miner, but generally these are the 3 critical pieces of information you need to change regardless of which software you choose.

- Replace —> cn.sparkpool.com:13333 —> us1.ethermine.org:4444

- Replace —> 0x4296116d44a4a7259B52B1A756e19083e675062A —> YOUR_WALLET_ADDRESS

- Replace —> default —> YOUR_RIG_NAME

Additional NB Miner Commands

- -lhr ## —> (## is % of full hashrate target)

- -lhr-mode 2 —> (Default lhr mode, this is the low power mode)

- -lhr-mode 1 —> (Original lhr version, NB miner 39.2)

-

Add Bat File To Windows Start-up

Now that the Bat file is set up, lets add a shortcut of the Bat file to the Windows startup folder so that whenever the computer starts it automatically run the mining software.

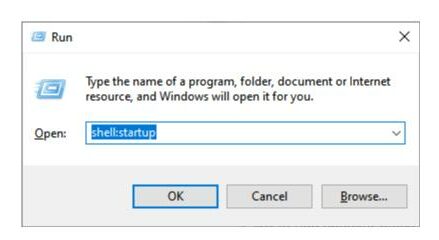

Press Windows+r to open run command.

In the window that pops-up type —> shell:startup

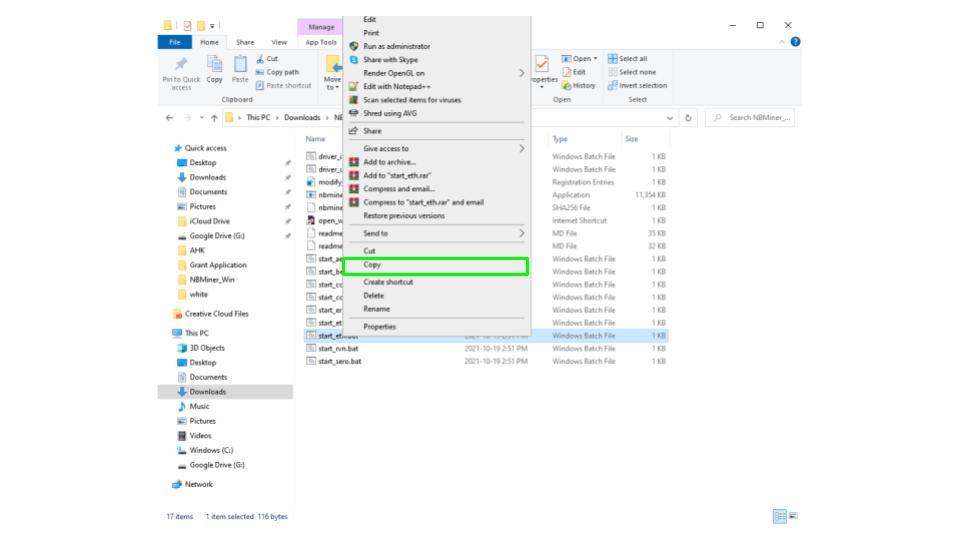

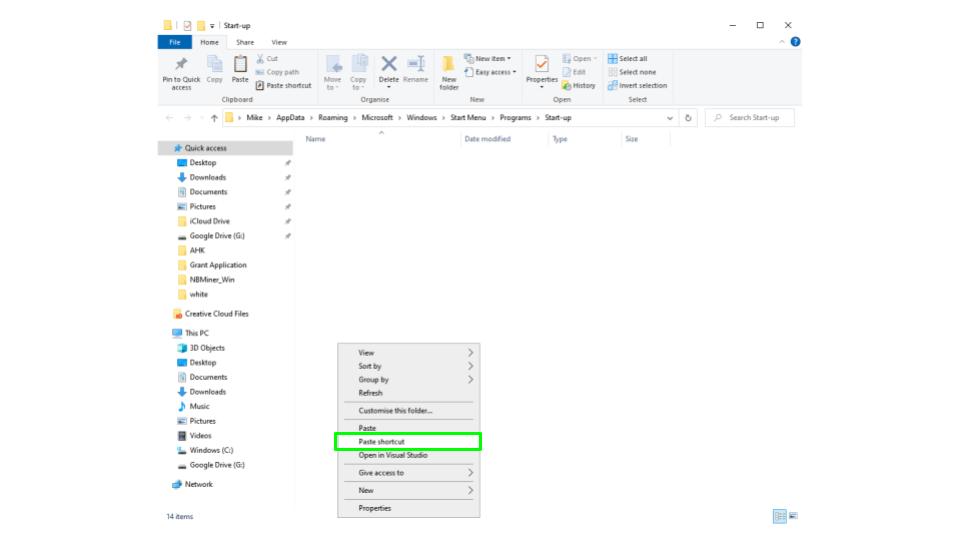

This will open the start-up folder.Now go to the miner folder and find the Bat file you just edited. Copy the file and paste a shortcut in the startup folder.

The miner will now automatically run when Windows starts.

-

-

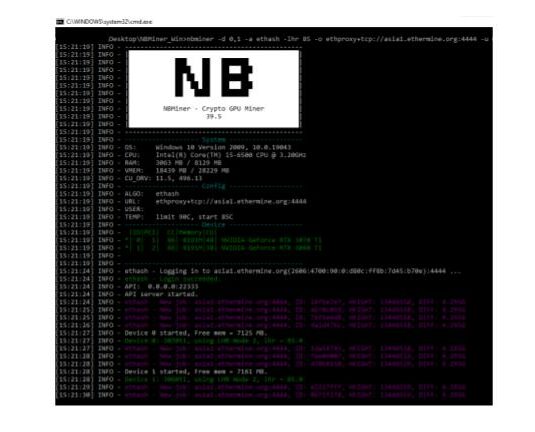

Run Miner

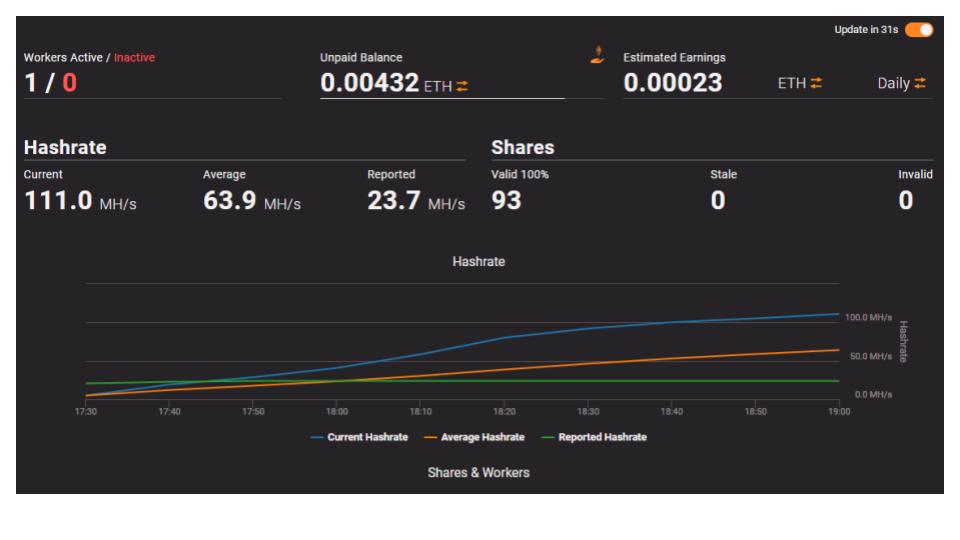

Now lets run the miner by opening the Bat file you modified. This should open a command prompt and you should see the miner load and begin to mine. You should see something that looks similar to this.

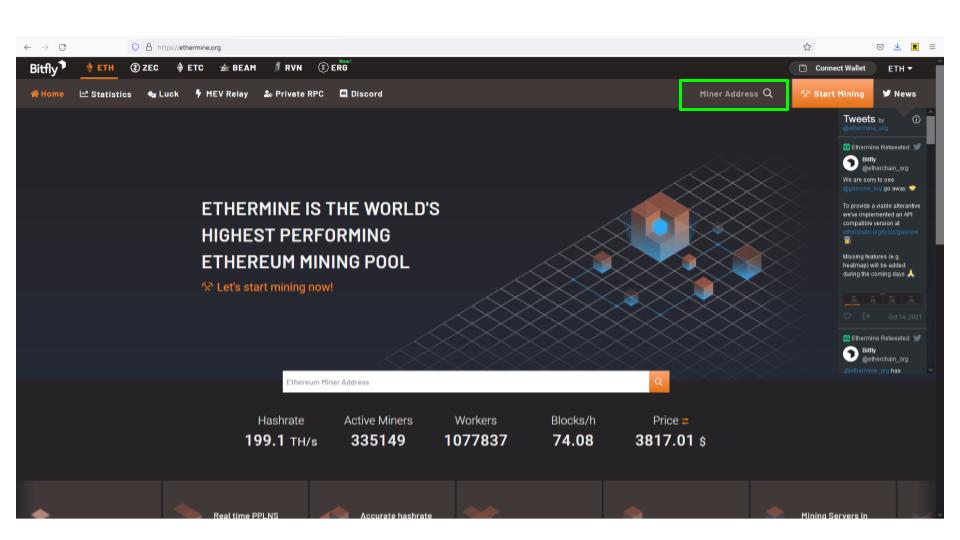

Once the miner is up and running, make sure to check out the mining pool to confirm that you are connecting properly, and that your rates are as expected. To do this head to Ethermine and in the top search bar enter in your wallet address.

It may take up to 10 minutes for Ethermine to update and recognize that you are connected.

-

Overclock Your GPU

If you want to increase your profits, then you want to make sure your card is running at the highest hash rate and the lowest power. To do this you will need to overclock your GPU. Overclocking your GPU can add wear and tear on the device and can potentially damage the GPU. Please be aware of the risks before overclocking.

-

Download MSI Afterburner

Many miners will allow you to hard code GPU overclocks in the Bat file, but if your looking for a quick easy method, MSI Afterburner is a great option. Download and install the program.

-

Modify Settings

Optimizing your overclock settings is beyond the scope of this article, but the general process is.

- Set power to max

- Set core clock to lowest value

- Check the hash rate (it may take a little time for the hash rate settle)

- Incrementally increase your core clock until the hash rate stops increasing or the card crashes (if the card crashed reduce core clock by 50)

- Set memory clock to minimum

- Incrementally increases the core clock until the hash rate reaches a maximum or the card crashes

- Incrementally decrease power until the hash rate start to decrease.

Once you have overclocked the card, let it run for a day or a week to see if its stable or if you are getting invalid shares. If the card is experiencing issues pull back the setting and let it run again. Different algorithms have different optimal overclock settings and even miner updates may require you to re-assess.

-

FAQ’s

Can crypto mining damage my GPU?

Mining does not do any more or less damage to your GPU than if you were gaming. There is however more wear and tear because it runs continuously. Also if you have overclocked the GPU this will put additional strain on it and reduce it’s life.

What is the best GPU for mining?

The best GPU for mining the one provides the highest return on investment (ROI). Crypto mining is all about maximizing your revenue and decreasing your expenses. Because of this which GPU is best often changes (esp. when prices fluctuations). Take a look at our article the Top Crypto Mining Websites to find out some tools you can use to pick the best mining GPU for you.

What pool should I mine to?

Choosing a mining pool depends on the pool fee, location and payout method. To learn more read our Mining Pool Payouts article and check the Top Crypto Mining Websites for some tools that will help you choose.

Hi I’m Mike, an active crypto investor DeFi enthusiast and crypto miner. I have been involved in crypto since March of 2021 and in DeFi since May 2021.

I’m also an avid outdoor adventurer!

October 15th, 2021| Mike Humphrey

-

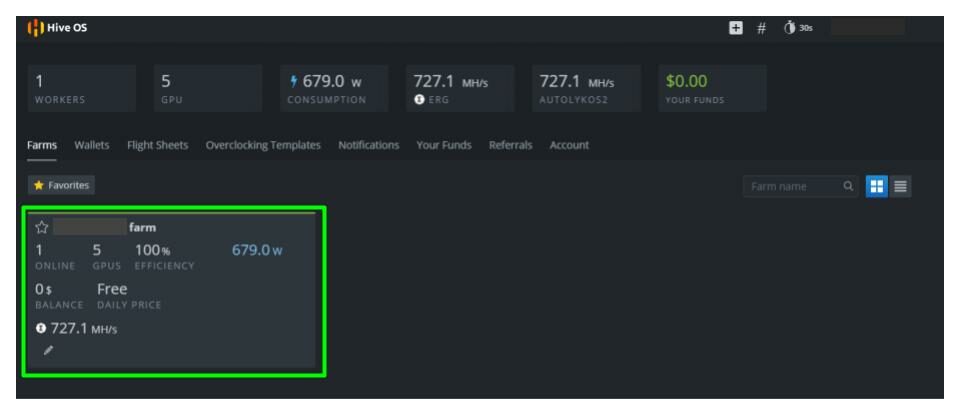

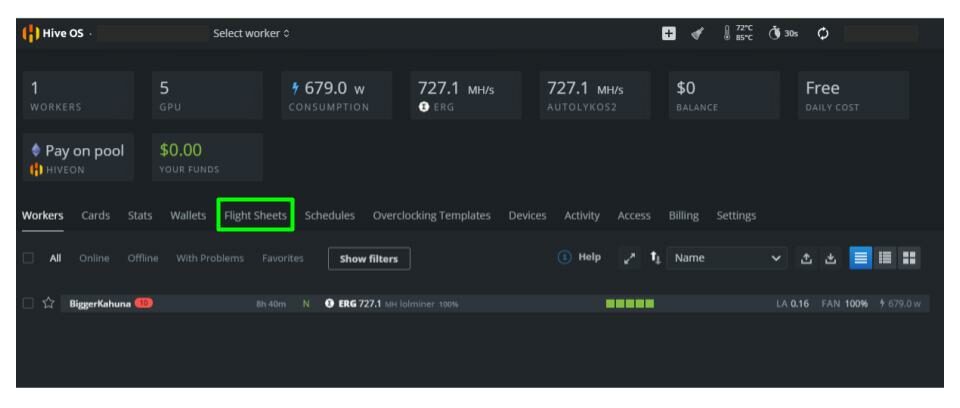

Open Hive OS

Log in to Hive OS and select the rig you want to dual mine with

-

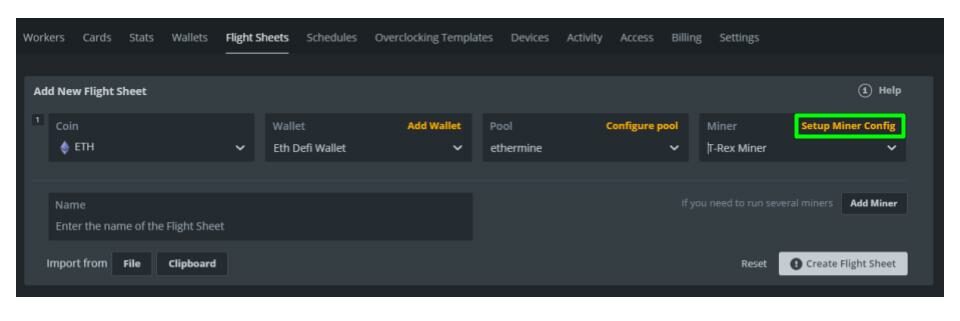

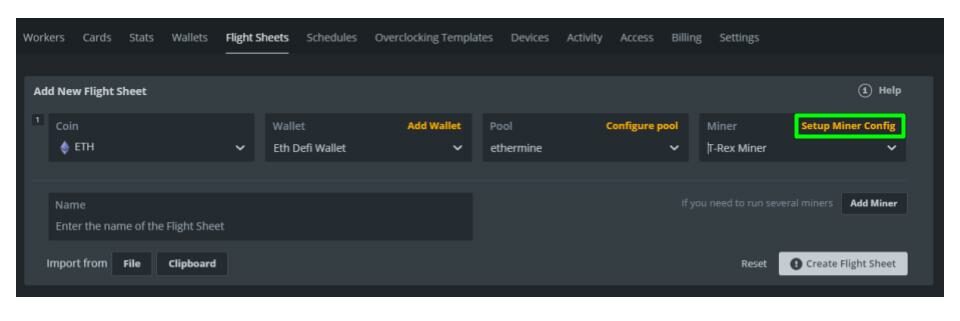

Set Up Flight Sheet

After selecting the miner choose the flight sheet tab to set up T-Rex miner for dual mining

Select Eth as the coin, choose your wallet and select and configure the mining pool you wish to mine to. In my case I mine to Ethermine on Polygon due to the low transaction costs which allows easy investment in DeFi. Set the Miner to T-Rex miner.

-

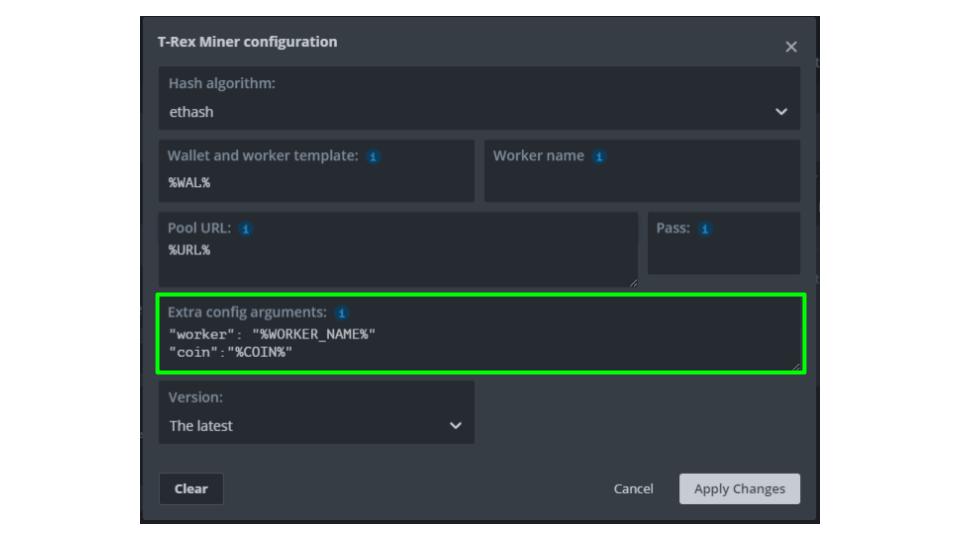

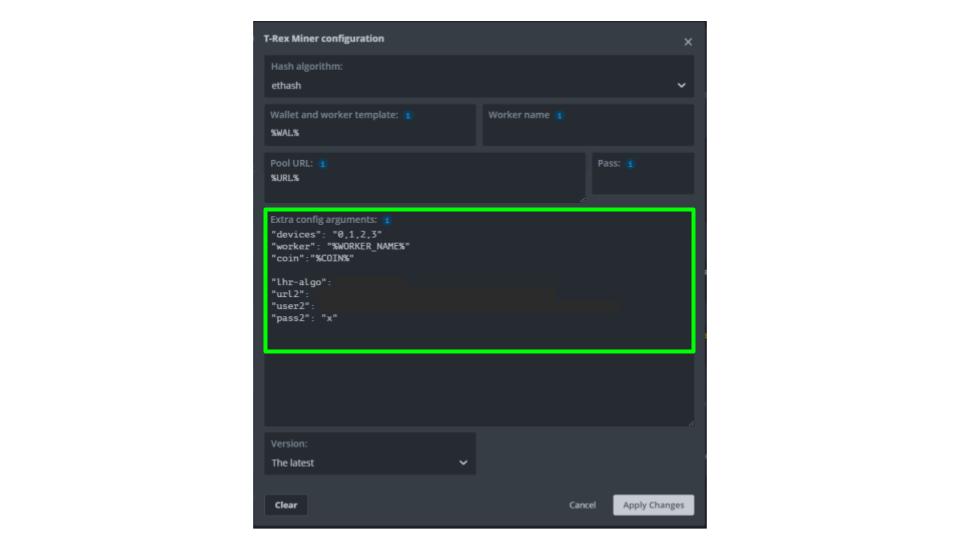

T-Rex Miner Config

Hive OS is now ready mine Ethereum using T-Rex, in order to set it up for dual mining we now have to make sure we configure the miner. To do this click on Setup Miner Config.

In the Miner Config settings make sure that the version is set to 0.24.0, higher or The latest. Once the version is set properly, expand the Extra Config arguments. This where we will enter in the additional commands to mine a second coin.

“devices”: “0, 1, 2, 3” (IGNORE THIS LINE – This sets which workers the flight sheet will apply to, remove this line if you want it to apply to all GPU’s)

“worker”: “%WORKERS_NAMES%” (DON’T CHANGE – This will pull the worker name you assigned to the rig in Hive OS)

“coins”: ” %COIN%” (DON’T CHANGE – pulls the coin name from the Hive OS)“lhr-algo”:”CHOOSE_AN_ALGORITHM” ( octopus, autolykos2, kapow)

“url2”: “YOUR_MINING_POOL_ADDRESS” (Enter your mining pool and IP)

“user2”: “YOUR_WALLET_ADDRESS” (Enter your wallet address here)

“pass2”: “x” (Enter your mining pool password here, leave as x if you don’t have a password)Once entered, Click Apply Settings

-

Overclock GPU

Now that the miner is set up we can set up the overclock settings to optimize mining. Click on the workers tab and select the mining rig to see the GPU’s in your rig. Click on the icon on the very right side of the miner

In the window that pops up you can apply the recommended settings.

T-Rex ETH+ERGO

Requires 8GB+ VRAM

Important: if your GPU is LHR-constrained on ERGO in single mode no matter what overclock you set, this dual mode is not for you as the miner will be constantly hitting LHR locks.

GPU ETH hashrate ERGO hashrate Power limit Overclock settings 3080Ti 35.4 MH/s 183.3 MH/s PL 82% (287W) mem +1000 (linux +2000), core 0 3080 31.8 MH/s 153.0 MH/s ~240W (locked clock) –lock-cclock 1580, mem +1525 (linux +3050), core 0 3070Ti 23.1 MH/s 123.9 MH/s ~170W (locked clock) –lock-cclock 1540, mem +1300 (linux +2600), core 0 3060 12.5 MH/s 74.5 MH/s ~90W (locked clock) –lock-cclock 1250, mem +1300 (linux +2600), core 0 T-Rex ETH+RVN

Requires 8GB+ VRAM on linux and 10GB+ on windows

GPU ETH hashrate RVN hashrate Power limit Overclock settings 3080Ti 35.7 MH/s 29.6 MH/s PL 82% (287W) mem +1000 (linux +2000), core 0 3060 14.8 MH/s 13.9 MH/s PL 60% (102W) mem +1300 (linux +2600), core 0 T-Rex ETH+CFX

Requires 10GB+ VRAM.

GPU ETH hashrate CFX hashrate Power limit Overclock settings 3080Ti 36.4 MH/s 60.6 MH/s PL 82% (287W) mem +1000 (linux +2000), core 0 3060 14.9 MH/s 26.7 MH/s PL 60% (102W) mem +1300 (linux +2600), core 0 -

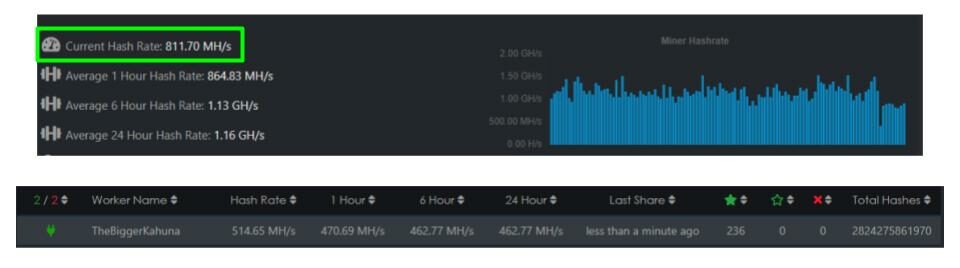

Results

Expected Rates

T-Rex ETH+RVN

| GPU | ETH hashrate | ERGO hashrate | Power limit | Overclock settings |

|---|---|---|---|---|

| 3080Ti | 35.4 MH/s | 183.3 MH/s | PL 82% (287W) | mem +1000 (linux +2000), core 0 |

| 3080 | 31.8 MH/s | 153.0 MH/s | ~240W (locked clock) | –lock-cclock 1580, mem +1525 (linux +3050), core 0 |

| 3070Ti | 23.1 MH/s | 123.9 MH/s | ~170W (locked clock) | –lock-cclock 1540, mem +1300 (linux +2600), core 0 |

| 3060 | 12.5 MH/s | 74.5 MH/s | ~90W (locked clock) | –lock-cclock 1250, mem +1300 (linux +2600), core 0 |

T-Rex ETH+RVN

Requires 8GB+ VRAM on linux and 10GB+ on windows.

| GPU | ETH hashrate | RVN hashrate | Power limit | Overclock settings |

|---|---|---|---|---|

| 3080Ti | 35.7 MH/s | 29.6 MH/s | PL 82% (287W) | mem +1000 (linux +2000), core 0 |

| 3060 | 14.8 MH/s | 13.9 MH/s | PL 60% (102W) | mem +1300 (linux +2600), core 0 |

T-Rex ETH+CFX

Requires 10GB+ VRAM.

| GPU | ETH hashrate | CFX hashrate | Power limit | Overclock settings |

|---|---|---|---|---|

| 3080Ti | 36.4 MH/s | 60.6 MH/s | PL 82% (287W) | mem +1000 (linux +2000), core 0 |

| 3060 | 14.9 MH/s | 26.7 MH/s | PL 60% (102W) | mem +1300 (linux +2600), core 0 |

See the T-Rex miner site for more updates

]]>

What is the Polygon Network

Polygon, previously known as the Matic Network a layer 2 scaling solution for the Ethereum blockchain. Using side chains and, roll-ups, polygon offers faster transaction speeds and lower gas fees while still maintaining security. Polygon performs transactions in parallel to the Etherium Mainnet. In basic terms, transactions on Polygon are bundled together before data is sent back to the main blockchain, which reduces the time required and the cost of each transaction.

The Polygon Network also introduced the token Matic, which is used for network transaction fees. Currently, gas fees on the Polygon Network cost less than 0.01USD per transaction, making Polygon a very cost-effective network.

In brief:

- Polygon is an Etherium layer-2 scaling solution.

- The Polygon Network uses MATIC as the gas fee token.

- Gas fees and transaction times are significantly less than on Etherium Mainnet

- Polygon has been widely adopted offering a wide variety DeFi Platforms

For a detailed description of Polygon, its history, and how it works, Finematics has a great video.

Why Should You Use Polygon

Polygon has several significant advantages over the Etherium main net. Primarily transaction fees are 1/1,000 to 1/10,000 of the fees on Etherium and transaction speed is significantly faster as well. With the low transaction cost and ease of use, the eco-system has flourished offering a wide array of DeFi apps that are now accessible to investors with smaller portfolios. Previously on Etherium without sufficient assets, fees would often cut into your profits making it challenging or even impossible for small-scale investors to get involved with DeFi.

How To Bridge Assets to Polygon

-

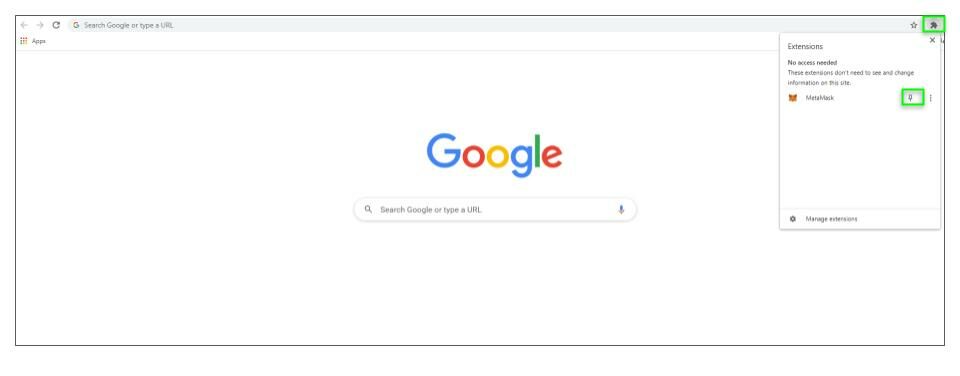

Install Metamask Extension

Metamask is a web wallet that has both a browser extension and an app. Metamask allows you to connect to DeFi websites where you can deposit, borrow, swap tokens and earn interest.

To install Metamask go to the Metamask.io website select the appropriate browser, download, and install. Be sure to double-check the accuracy of the website before installing.

Chrome doesn’t always pin Metamask after it’s been installed. If you can’t see the fox in the top right corner of the browser click on the puzzle icon in the top right and then pin Metamask to the top tool bar.

-

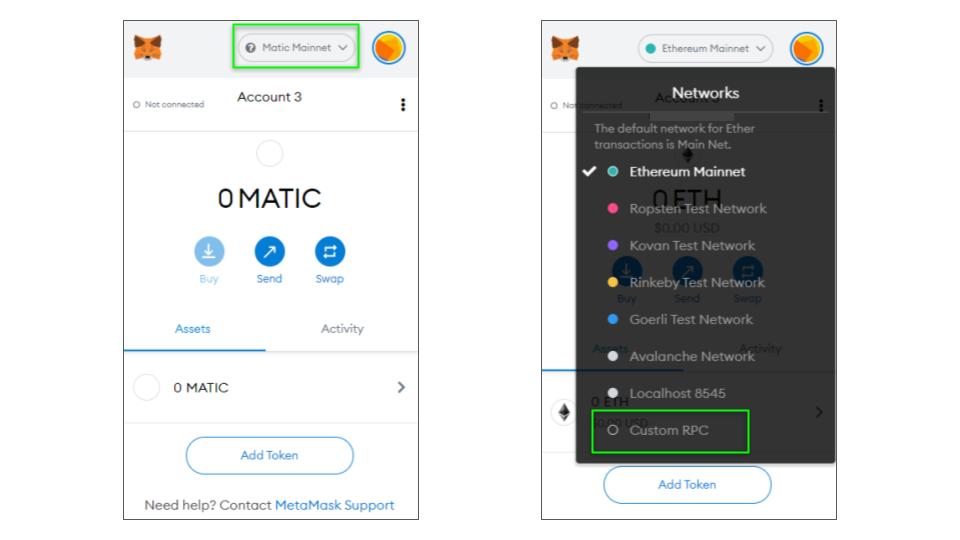

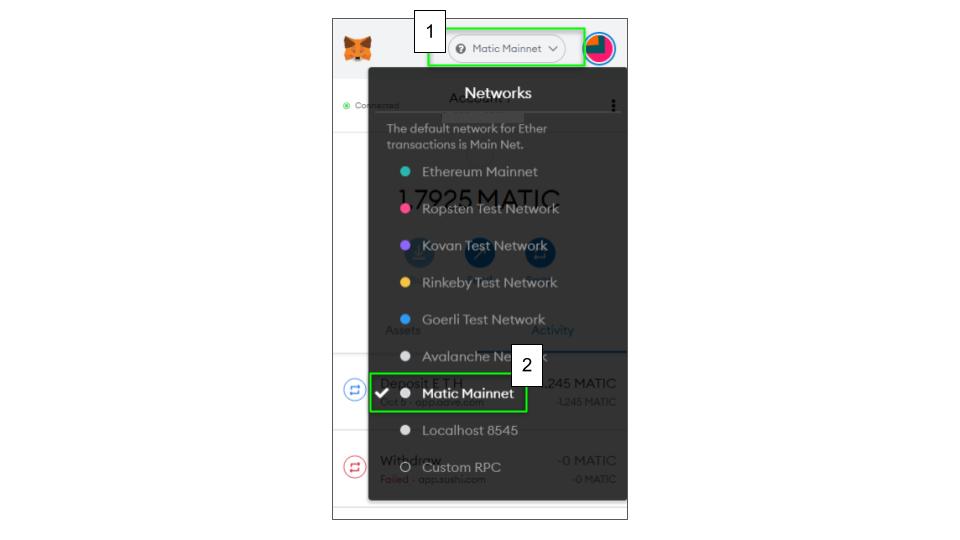

Add Polygon Network to Metamask

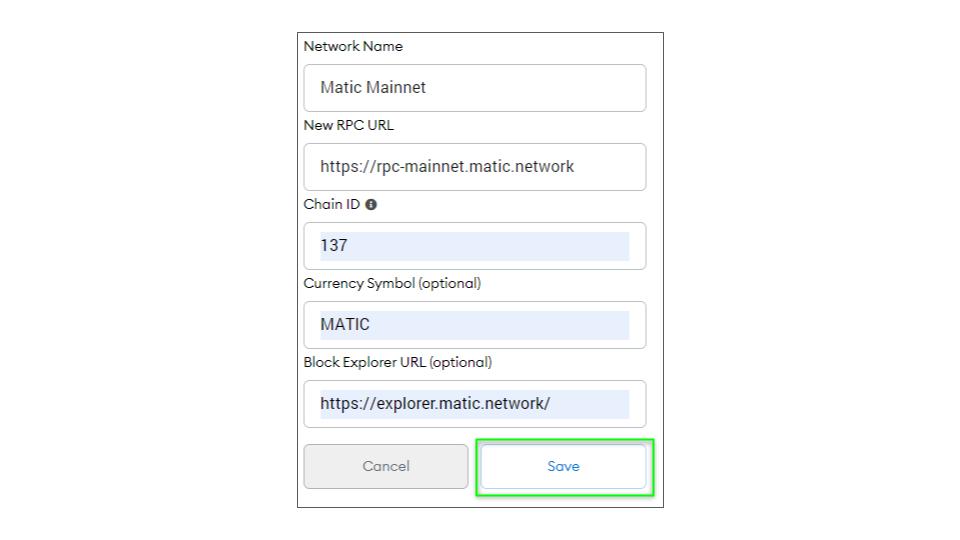

Metamask has the ability to connect to most blockchains that support ERC-20 (Etherium-based) tokens. When installed Metamask is set up to connect to Etherium Mainnet, but in order for it to connect to the Polygon Network we have to add Polygon to Metamask.

To add a new network open Metamask by clicking on the fox in the top right corner. In the pop-up window click on the top center button, it should say Etherium main net. In the drop-down list that appears select Custom RPC at the bottom.

In the new window enter the following Details:

Network Name: Matic Mainnet

New RPC URL: https://polygon-rpc.com

Chain Id: 137

Currency Symbol: MATIC

Block Explorer URL:https://polygonscan.com -

Bridge Tokens to Polygon

Now that you have successfully connected Metamask to the Polygon Network it’s time to move your funds from the Etherium Mainnet over to Polygon. To do this you will need to move your assets onto the polygon Network using the Polygon Bridge.

-

-

-

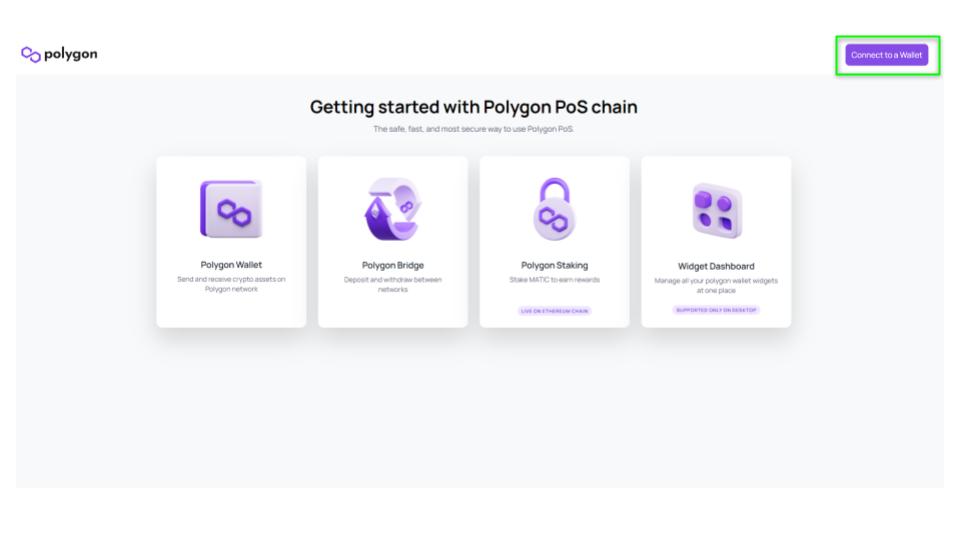

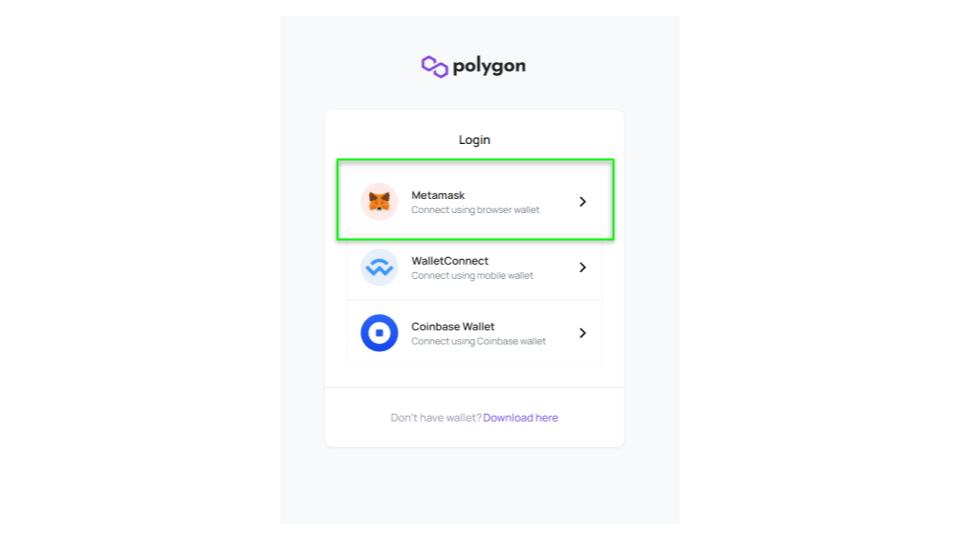

Connect Metamask to The Polygon POS Bridge

First, make sure that Metamask is set to the Matic Network.

Then go To the Polygon Matic Bridge at https://wallet.polygon.technology/.

-

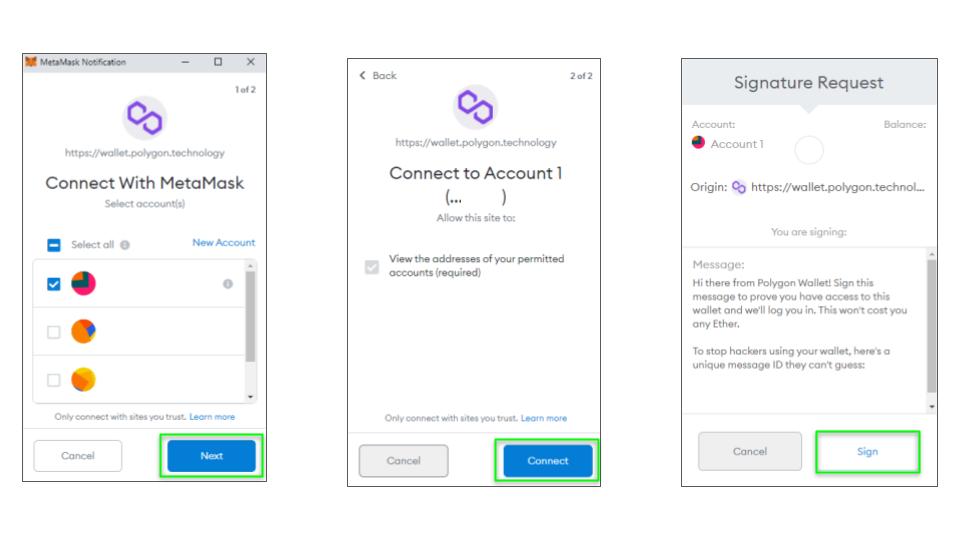

Connect Metamask To The Site

-

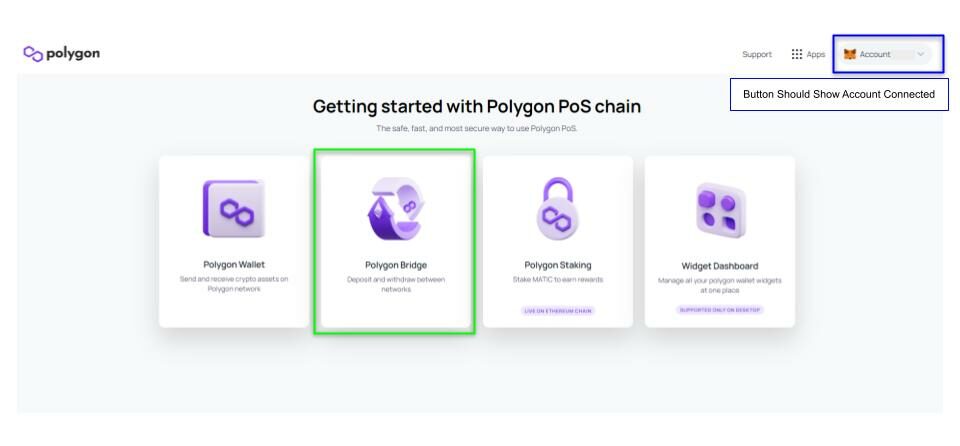

Select The Polygon Bridge

When your wallet is connected to the site, the top button should turn grey and you should see a portion of your wallet address. Once connected select the Polygon Bridge

-

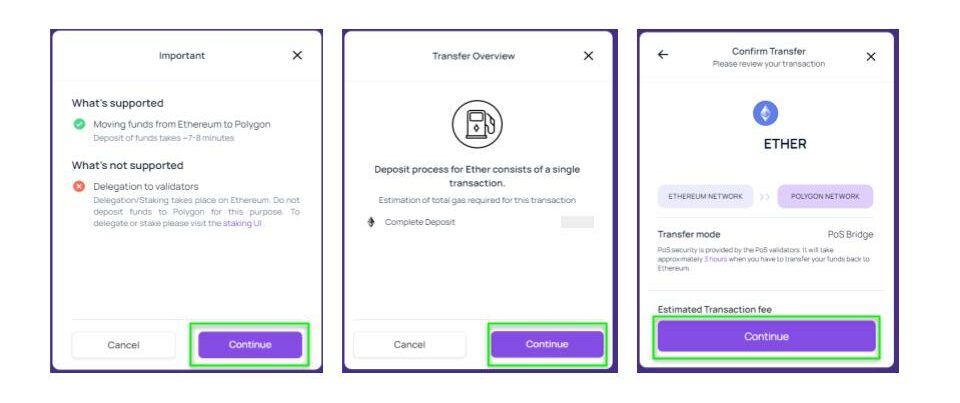

Bridge Your Assets

You can bridge any ERC20 coin to polygon, but we would recommend starting with Eth. There is no point in swapping tokens on the Mainnet when they can be easily swapped on Polygon at a significantly lower cost. (Assuming you have Eth of course. If you have another token then we recommend just swapping that.)

Enter how much Eth you want to bridge to polygon keeping in mind you will have to pay gas fees on Mainnet in Eth in order to perform the transaction.

Approve and confirm the transaction and gas fees.

-

Wait for the Transaction to Complete

The transaction should take 7-8 minutes to complete, but this varies depending on network congestion. You can check on the progress of the transaction on Etherscan as well as https://wallet.polygon.technology/wallet.

-

-

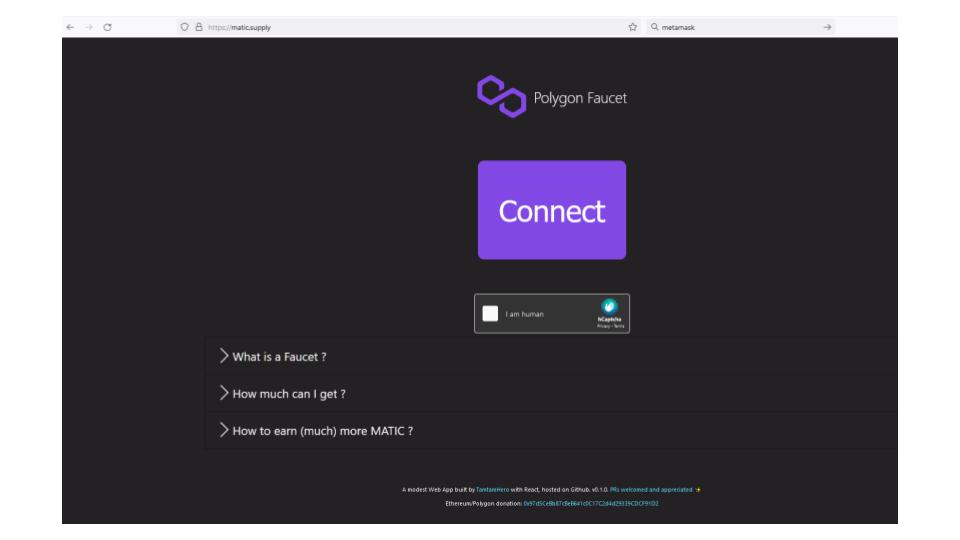

Matic Tokens for Your First Transaction

In order to perform any transaction on the Polygon Network, you will need Matic tokens. You can either buy these from an exchange, or you can go to a faucet, where people donate small amounts of tokens to people who are new to the ecosystem. Matic supply is a well-known faucet that we have successfully used in the past.

Simply connect your wallet and complete the captcha to receive a small amount of Matic. After this, you can go to any swap platform to exchange your Eth for Matic for future transactions.

Disconnect From The Sites When Finished to Keep Metamask Secure (the three dots in the top right corner of Metamask)

-

-

Let us know what other guides you would like us to put together in the comments.

Hi I’m Mike, an active crypto investor DeFi enthusiast and crypto miner. I have been involved in crypto since March of 2021 and in DeFi since May 2021.

I’m also an avid outdoor adventurer!